As rumors circulate about a potential $1,390 relief payment from the Internal Revenue Service (IRS) in 2025, many Americans are wondering if they’re eligible for a direct deposit. However, the facts surrounding these claims are more complicated than they appear.

Table of Contents

$1,390 IRS Relief Payment 2025

| Key Fact | Detail |

|---|---|

| IRS 2025 Relief | No new federal payments for $1,390 have been announced. |

| State Relief Programs | States like California and New York offer separate inflation relief payments. |

| Scam Risks | Fraudulent messages targeting $1,390 relief are widespread. |

The rumors surrounding the $1,390 IRS relief payment for 2025 are misleading. As of now, there are no federal relief programs offering such payments. If you are looking for financial relief, check with your state government for any available programs and be wary of scams targeting people hoping for a direct deposit.

Always refer to official sources such as the IRS website or your state’s official tax agency for the most accurate and up-to-date information.

The $1,390 Payment Rumor: Where It Comes From

Over the past few weeks, several online reports have mentioned a $1,390 IRS relief payment set to arrive in 2025. These rumors are largely based on unverified sources and speculative headlines. For context, the U.S. government issued several rounds of stimulus checks during the COVID-19 pandemic to provide economic relief to millions of Americans.

Since then, similar payment programs have been proposed at both the federal and state levels. However, no official announcement has been made regarding any new federal stimulus payments for 2025.

The notion of a $1,390 payment seems to be part of a larger trend of misinformation surrounding possible economic relief. Social media platforms and unofficial news sites have fueled these rumors, prompting many to ask: Am I on the list for direct deposit?

IRS Response: No New Federal Stimulus Checks in 2025

The IRS (Internal Revenue Service) has made it clear that there are no federal plans for another round of direct stimulus payments in 2025. The IRS and the U.S. Department of Treasury both confirmed there are no provisions for sending out such payments in the current year. These payments are not part of any new economic relief measures, and taxpayers should be cautious of misleading information.

“In 2021, the federal government provided a final round of economic impact payments as part of the American Rescue Plan, but no new federal direct payments have been authorized,” said Dr. Martha Holloway, an economist at the Federal Reserve Bank of New York.

Furthermore, the U.S. Department of the Treasury has warned taxpayers to be aware of scammers using these rumors to trick people into providing personal information. Phishing scams have become increasingly prevalent, often targeting people who are expecting a payment.

State-Level Relief Programs: Separate From the IRS Payments

While there is no federal program offering relief payments in 2025, several U.S. states have launched their own relief initiatives. Some of these are designed to offset inflationary costs and help households struggling with high living expenses.

For example, states like California, Colorado, and New York have issued one-time inflation rebates or tax relief payments that may reach similar amounts to the rumored $1,390 federal relief.

However, it is important to note that these payments are administered by state governments, not the IRS, and they have their own eligibility requirements and timelines.

For instance, California’s Middle-Class Tax Refund issued payments to eligible residents, with amounts ranging between $350 and $1,050 depending on income levels and filing status. States like New York have issued rebates to qualified residents to counteract rising living costs, especially energy expenses. These state-level programs typically do not require additional action by taxpayers if they already filed taxes in the past year.

How Do You Know If You’re Eligible for Relief Payments?

Eligibility for state-level relief payments varies depending on the specific program in question. While the IRS has no plans to issue a $1,390 relief payment, other states may have programs that provide direct payments. Here are some key points to consider:

- Income Requirements: Most states offering inflation rebates have income limits. For instance, California’s Middle-Class Tax Refund program issued payments to residents with incomes up to $250,000 for individuals or $500,000 for joint filers.

- Filing Requirements: Some states require you to file your taxes in a specific year to be eligible for relief payments. In some cases, you must have filed a 2020 or 2021 tax return.

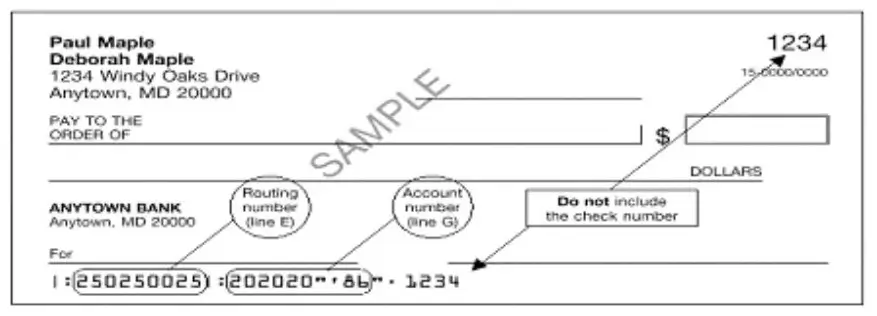

- Direct Deposit vs. Paper Checks: States may offer either direct deposit or paper checks as payment methods, depending on how you received your tax refund or filed your return.

- Timelines: Payment dates can vary significantly. In some cases, payments have been processed in early 2025, while others are still pending based on eligibility checks and state-specific budgets.

Scam Alert: Be Cautious of Fraudulent Claims

One of the most significant concerns regarding the $1,390 relief payment rumors is the potential for fraud. Scammers often take advantage of economic uncertainty by crafting messages that exploit people’s hopes for additional financial support.

Common tactics include fraudulent calls, emails, and text messages that claim the recipient is eligible for a stimulus check or tax rebate, requiring sensitive information such as a Social Security Number or bank account details.

The IRS warns taxpayers to avoid clicking on links or providing any personal information in response to unsolicited communications, especially when these claims are unverified. If you receive an email or message claiming you are eligible for a $1,390 payment, it is highly likely to be a scam.

Related Links

VA Boost: $3,500+ Monthly Payments Coming for Qualified Veterans in 2025

$5,000 Checks Coming Soon — Check If You’re Getting Paid This Week

Looking Ahead: What To Expect in 2025

While there are no plans for a $1,390 IRS relief payment, this year could still bring other forms of financial assistance. Federal lawmakers continue to discuss various economic measures, including potential child tax credits and extended unemployment benefits.

However, for now, any relief payments outside of typical tax refunds and state-level programs are unlikely. Experts are advising that taxpayers should stay updated through trusted sources like the IRS website or news agencies regarding any changes to relief programs.

In addition, state governments may continue to release additional inflation rebate payments or tax refunds. It is essential to keep track of any announcements related to state-level assistance, as many individuals could be eligible for different types of financial aid.

FAQ About $1,390 IRS Relief Payment 2025

Q: Will there be another federal stimulus payment in 2025?

A: No, there are currently no plans for another federal stimulus payment like those issued during the COVID‑19 pandemic.

Q: How do I know if I’m eligible for state relief payments?

A: Eligibility depends on the state’s program, typically based on income level and tax filing status. Check with your state’s tax authority for specific details.

Q: Are there scams related to the $1,390 payment rumors?

A: Yes, scammers are taking advantage of these rumors by sending fraudulent messages. The IRS warns to avoid sharing personal information in response to unsolicited offers.