Rumors about a $1800 stimulus boost arriving for millions of Americans have spread rapidly online in recent weeks. But federal agencies, including the Internal Revenue Service (IRS) and the U.S. Department of the Treasury, have confirmed that no new stimulus checks have been authorized in 2025. Economic experts warn that such claims are frequently tied to phishing scams designed to exploit public uncertainty.

Table of Contents

$1800 Stimulus Boost

| Key Fact | Detail |

|---|---|

| No $1,800 stimulus program | Federal officials confirm no new stimulus legislation in 2025. |

| Rumor origin | Unverified websites and social media claims. |

| Active relief programs | Tax credits, Social Security COLA adjustments, state rebates. |

| Scam risk | Fraud attempts using stimulus language are increasing. |

| Official website | IRS |

No Official Authorization for a $1800 Stimulus

The IRS has emphasized that no new stimulus payments have been authorized by Congress or signed into law by the president. Unlike the economic relief payments distributed during the pandemic, this alleged payment has no legislative backing or official announcement.

An IRS spokesperson explained in a recent briefing that the agency “will not contact taxpayers through email, text, or social media to offer payments or request personal information.” Any claims suggesting otherwise should be considered suspicious.

This position aligns with how stimulus programs have historically worked in the United States. Economic relief payments require formal legislation, budget approval, and a structured rollout through official government portals.

Where the $1800 Rumor Likely Originated

Misunderstood Adjustments

Some of the rumors appear to be tied to routine benefit adjustments—such as Social Security cost-of-living increases—that were misrepresented as a new federal stimulus program. These adjustments are normal and incremental, not one-time relief checks.

Nostalgia for Past Stimulus Checks

During the pandemic, stimulus payments were widely distributed in 2020 and 2021, creating a lasting public memory. The current rumor may be exploiting this familiarity, making a fake program seem believable.

Exploited Trust in Government Messaging

Scammers often use language that resembles official IRS or Treasury announcements. By mimicking this language, they can trick people into providing sensitive information like Social Security numbers or bank account details.

What Real Relief Programs Exist

Although there is no federal $1800 stimulus boost, several legitimate assistance programs remain active:

- Social Security COLA adjustments: Beneficiaries receive annual increases tied to inflation.

- Earned Income Tax Credit (EITC): Low- and moderate-income workers may qualify for tax relief when they file their returns.

- Child Tax Credit: Families with children may receive refundable tax credits, depending on eligibility.

- State-level rebates: Some states issue tax refunds or rebates tied to surplus budgets or inflation relief programs. These are state programs, not federal stimulus checks.

These programs are administered through official channels, and recipients are never contacted through unsolicited emails or text messages.

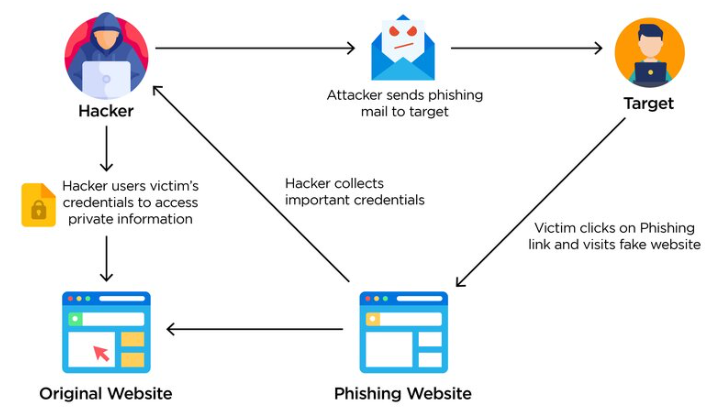

How Scams Use Stimulus Language

Phishing scams linked to stimulus check rumors typically follow recognizable patterns:

- Unsolicited Contact: The scam begins with an unexpected message claiming that a payment is “waiting” for the recipient.

- Urgency and Pressure: The message often warns that the person must “act now” or risk losing the money.

- Request for Information: Scammers then ask for bank account numbers, Social Security details, or other personal data.

- Fake Websites: Some messages link to websites that mimic the IRS or Treasury portals but use fake domains.

Security experts warn that these scams often target older adults, low-income households, and those who previously received legitimate stimulus payments.

How to Protect Yourself from Stimulus Scams

To avoid falling victim to these schemes, experts and officials recommend:

- Do not click on links in unsolicited emails or texts.

- Verify any claim directly on official government websites, not through third-party links.

- Never provide personal information like bank details, Social Security numbers, or PINs in response to unexpected messages.

- Report suspicious messages to the IRS or the Federal Trade Commission.

- Use multi-factor authentication for financial accounts to reduce the impact if credentials are stolen.

If personal information has already been shared, individuals should consider placing fraud alerts on their credit reports and closely monitoring bank activity.

Why a Future Stimulus Could Happen — and How It Would Be Announced

Although no $1800 stimulus exists today, it is possible for new relief measures to be introduced in the future — but only through formal legislative channels.

For a federal stimulus to occur:

- Congress must pass a new relief bill.

- The president must sign the legislation.

- The Treasury Department and IRS must announce the rollout publicly.

- Eligibility criteria and payment timelines must be clearly defined.

If such a program were approved, it would be reported widely through major news outlets, official government websites, and direct IRS mailings — not through viral posts.

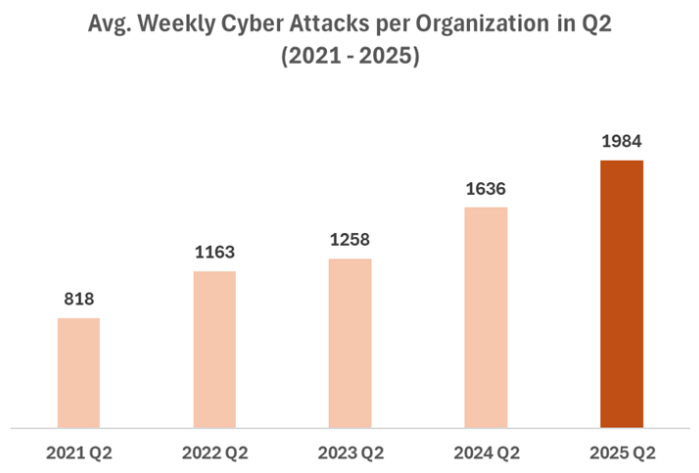

Economic Context: Why Rumors Spread

The U.S. economy continues to face high costs of living, especially for essentials like housing, healthcare, and food. Inflation pressures and wage stagnation have made many households more receptive to claims of financial relief.

According to economists, this creates an environment where stimulus rumors can spread quickly, particularly during periods of economic stress. Scammers exploit both financial anxiety and the public’s previous experience with genuine payments.

Historical Stimulus Payments in the U.S.

Understanding the history of past stimulus programs helps explain why such rumors are persuasive:

- 2008 Economic Stimulus Act: Issued rebate checks to taxpayers during the financial crisis.

- 2020 CARES Act: Provided direct payments to millions during the COVID-19 pandemic.

- 2021 American Rescue Plan: Expanded relief measures with additional payments and tax credit enhancements.

In each of these cases, payments followed formal government announcements, press briefings, and official IRS communication. None were distributed quietly or without legislation.

Red Flags to Watch For

Experts recommend being alert to the following signs of a false stimulus claim:

- Promises of payments not announced on official government channels.

- Messages from non-government email domains.

- Requests for “activation fees” or deposits to receive a payment.

- Poor grammar or spelling errors in messages claiming to be official.

- Claims that “everyone qualifies” for a payment with no mention of eligibility rules.

These are almost always signs of a scam.

What to Do If You Are Targeted

If someone receives a fraudulent message:

- Do not respond or click on any links.

- Take a screenshot of the message for reporting.

- Forward the message to the IRS fraud reporting address or appropriate state agency.

- Delete the message from your device.

- Monitor financial accounts for any unauthorized activity.

Individuals who provided personal information should immediately contact their bank, credit bureaus, or the Social Security Administration to secure their accounts.

$400 Stimulus Checks Confirmed: Timeline for New York Payments Announced

Social Security SSI Checks: Exact November 2025 Payment Dates You Can Count On

Social Security 2026 COLA Set at 2.8%: Why Many Seniors Are Still Struggling? Check Details

Expert Insight

Economists and security experts stress the importance of skepticism when it comes to unsolicited financial offers.

“Any real federal payment comes with congressional debate, presidential approval, and weeks of advance notice,” said Daniel Reyes, a senior economics professor. “If a message arrives before a press conference, it’s almost certainly a scam.”

Looking Ahead

While stimulus payments remain a tool the U.S. government can use during crises, there is no active or pending $1,800 stimulus program in 2025. Future relief measures would follow a structured process with transparent communication.

Financial experts advise the public to stay informed through trusted news sources and official agencies, not viral claims. As scams grow more sophisticated, awareness remains the most powerful defense.