New York State has begun issuing Inflation Refund Checks worth up to $400 to more than eight million households, state officials confirmed this week. The one-time payments, designed as a cost of living relief measure, aim to ease financial pressure as prices for food, housing, and utilities remain persistently high across the state.

Table of Contents

$400 Inflation Refund Checks

| Key Fact | Detail |

|---|---|

| Payment amount | Up to $400 per eligible household |

| Eligible recipients | 8.2 million New Yorkers |

| Start of distribution | Late September 2025 |

| Application required | No — issued automatically |

| Program funding | $1.9 billion |

| Official Website | New York State Department of Taxation and Finance |

What Are the Inflation Refund Checks?

The Inflation Refund Checks are part of a state tax refund program approved in the 2025 New York State budget. The initiative redistributes surplus tax revenue to residents most affected by inflation. According to the New York State Department of Taxation and Finance (NYSDTF), payments are calculated using a taxpayer’s 2023 income and filing status.

Individuals earning up to $75,000 qualify for $200, while married couples filing jointly with income under $150,000 receive the full $400. Higher-income brackets receive smaller refunds on a sliding scale. The payments are automatic—no application is necessary.

“Our goal is simple: return some of the state’s surplus to the people who helped create it,” said Amanda Hiller, New York’s acting tax commissioner. “These checks will help families cover essentials during an expensive year.”

The Origins of the Program

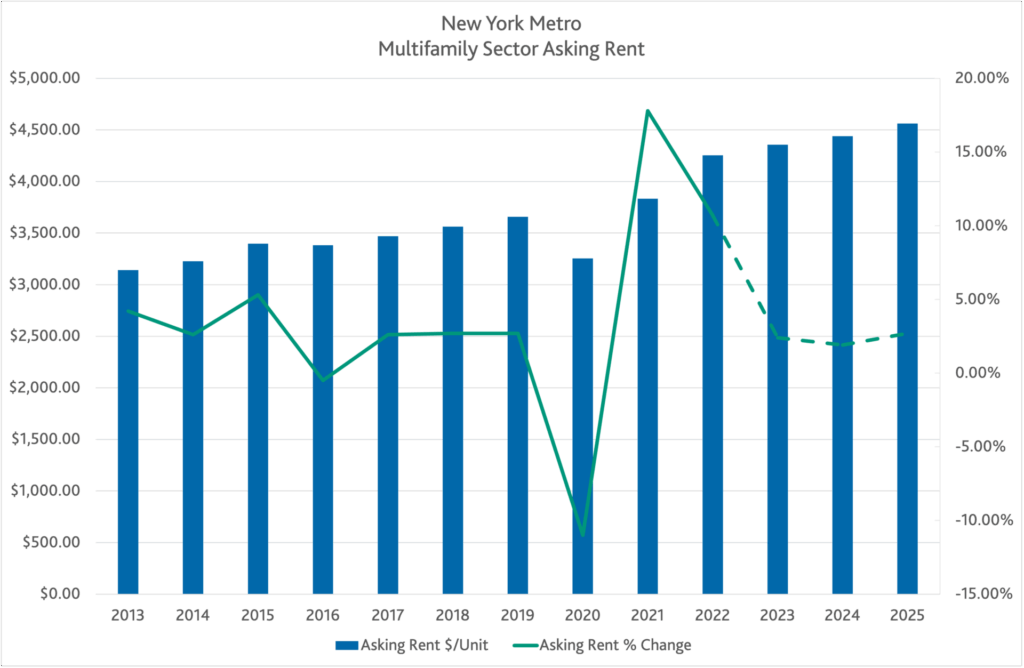

Governor Kathy Hochul proposed the measure in early 2025 amid rising frustration over the state’s cost of living. At the time, New York’s inflation rate stood at 3.6 percent—slightly above the national average—and rent prices in New York City had climbed more than 10 percent year-over-year.

“We’re using every tool at our disposal to ensure hardworking New Yorkers aren’t left behind by inflation,” Hochul said in a March briefing. “This refund is a responsible way to share our fiscal stability.”

The plan won bipartisan support in Albany, with both Democratic and Republican lawmakers viewing it as a politically unifying step ahead of the 2026 state elections. Some fiscal conservatives, however, argued that the rebates would offer only “temporary relief” without addressing structural cost drivers.

Who Qualifies and How Payments Are Distributed

To qualify, residents must have filed a 2023 NYS resident income tax return (Form IT-201) and must not have been claimed as dependents. The checks are mailed automatically to the most recent address on record.

NYSDTF said distributions began in late September 2025 and will continue through mid-November, processed in waves. There is no online tracker for the refunds, and payments are not sent via direct deposit.

“We are mailing tens of thousands of checks daily,” said Department spokesperson James Gazzale. “Residents do not need to call or apply—if they’re eligible, their refund will arrive.”

Officials urge taxpayers to update their addresses to prevent delays. Replacement requests can be filed if a check is lost or stolen.

Real-World Impact: Relief and Reality

For many residents, the payments are a modest but meaningful boost. In Rochester, single mother Tanya Brooks said her $200 refund “came right in time” for back-to-school expenses. “It’s not life-changing,” she said, “but it’s groceries and gas for the week—and that matters.”

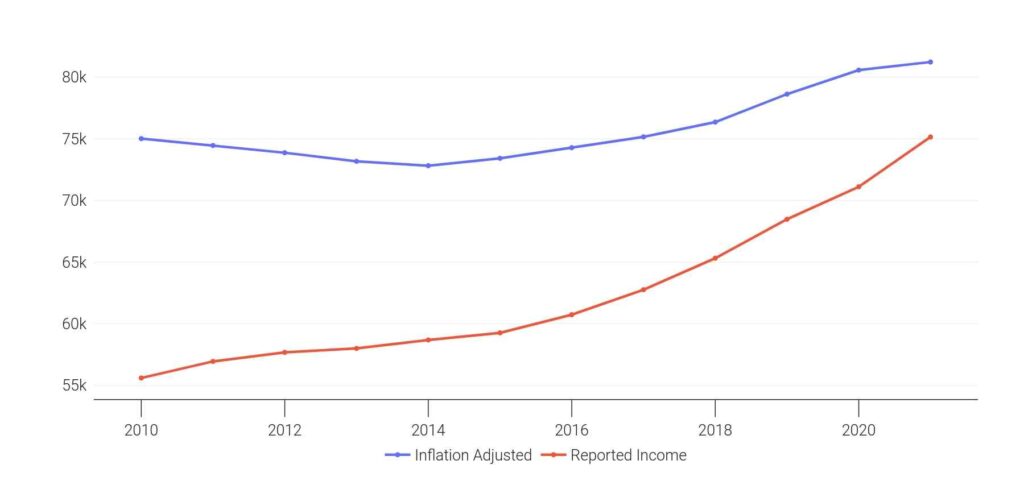

Economists note, however, that the refunds’ purchasing power is limited.

“A one-time $400 payment doesn’t offset a 15 percent rent hike,” said Dr. Elaine Porter, professor of economics at Columbia University. “But symbolically, it shows the state recognizes the financial pressure on households.”

Consumer advocates add that timely disbursement is critical. Past relief efforts, such as 2022’s homeowner tax rebates, were criticized for uneven rollouts.

Funding the Program

The $1.9 billion cost is drawn from higher-than-expected tax revenues collected in 2024 and early 2025. Inflation pushed sales and income tax receipts above projections, creating a surplus that lawmakers opted to return to residents rather than expand spending.

According to the New York State Division of the Budget, the refund is “fiscally neutral,” meaning it does not add to the state deficit or require borrowing.

Still, some analysts warn of long-term sustainability risks if revenues decline.

“Using one-time windfalls for refunds is fine, but it’s not a recurring solution,” said Patrick Orecki, policy director at the Citizens Budget Commission. “New York’s spending trajectory remains steep.”

Broader Economic Context

The program coincides with a national slowdown in inflation following the Federal Reserve’s decision to hold interest rates steady for the third consecutive quarter. Still, essentials such as housing, childcare, and healthcare continue to outpace wage growth in many parts of the state.

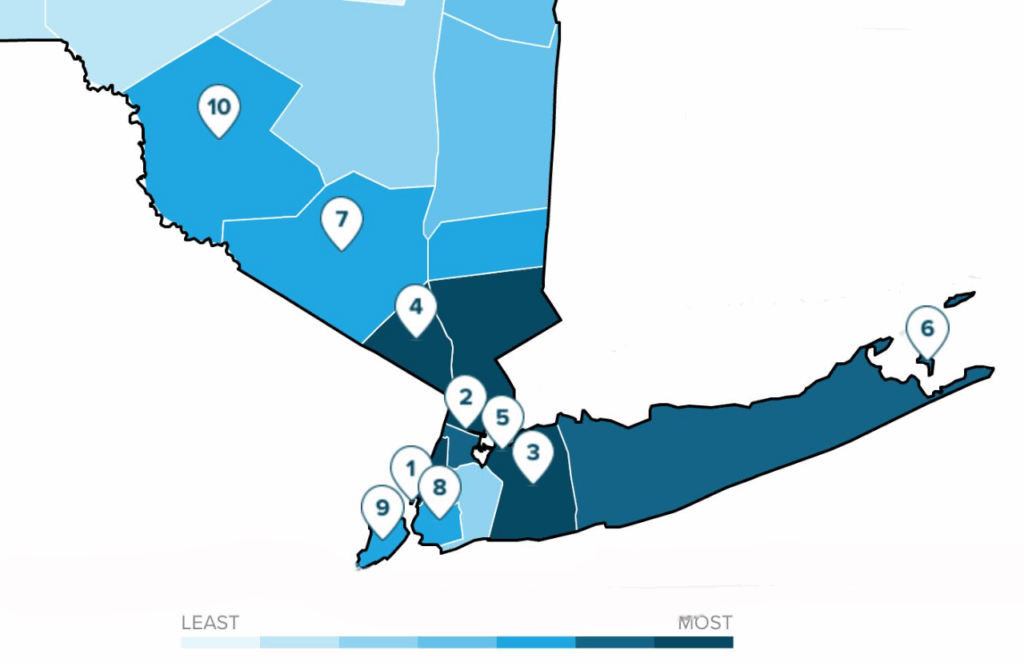

Data from the U.S. Bureau of Labor Statistics (BLS) show that New York City households spend nearly 35 percent of income on housing—well above the national average of 30 percent. Rural counties, while facing lower housing costs, report higher transportation and energy burdens.

“Inflation doesn’t affect everyone equally,” said Dr. Matthew Liang, senior economist at the Pew Research Center. “Programs like this can target relief to the groups hit hardest—low- and middle-income earners.”

Comparison With Other States

New York’s plan mirrors California’s Middle Class Tax Refund and Colorado’s TABOR rebates, both issued between 2022 and 2024. However, New York’s approach is narrower in scope, focusing on lower-income earners rather than all taxpayers.

According to the Tax Foundation, more than 20 states have issued some form of inflation relief since 2022. The typical payment ranged between $200 and $1,050, depending on income and family size.

“These checks are politically attractive because they’re tangible,” said Jared Walczak, vice president at the Tax Foundation. “But their macroeconomic impact is small. They’re relief, not stimulus.”

Political and Public Reactions

While broadly popular, the program has stirred debate over timing and intent. Critics in the state legislature argue it was announced too close to the 2026 election cycle.

“It’s good policy, but it’s also good politics,” said Assemblyman Robert Smullen, a Republican from the Mohawk Valley. “We support helping residents, but let’s not pretend it’s unrelated to campaign season.”

Voters, however, appear receptive. A Siena College poll conducted in October found that 72 percent of New Yorkers approve of the payments, including a majority of independents and Republicans.

Public sentiment also reflects deeper anxiety about affordability. “People see the refund as acknowledgment that the cost of living is out of control,” said Dr. Marybeth Foley, a political analyst at SUNY Albany.

Potential Federal Tax Implications

The Internal Revenue Service (IRS) has not yet clarified whether the refunds will be taxable federally. In 2023, a similar issue arose when states issued pandemic-era rebates, prompting confusion over income reporting.

Tax experts recommend waiting for official guidance before filing 2025 federal returns.

“Taxability will depend on whether the payment is considered a rebate of state taxes or a new benefit,” explained Lisa Leung, a certified public accountant in Manhattan. “Residents should keep documentation of their refund check.”

Looking Ahead: Relief or Short-Term Fix?

Whether the Inflation Refund Checks will have lasting effects remains uncertain. Economists say one-time transfers can provide breathing room but do little to address systemic cost challenges such as housing shortages and healthcare expenses.

“Targeted refunds help individuals, not economies,” said Dr. Porter of Columbia University. “Long-term relief requires wage growth, productivity, and stable prices.”

State lawmakers are reportedly exploring a follow-up initiative in 2026 focused on property tax relief for homeowners and renters, although no details have been finalized.

90% VA Disability Benefits Just Changed for November 2025 – See What You’re Owed Now

$5,000 Wells Fargo Settlement Payout – Key Dates, Eligibility, and How to Receive Your Money

$425M Capital One Settlement – Here’s How to Claim Before It’s Too Late

Public Awareness and Safety Warnings

Officials warn of increasing scams targeting residents awaiting payments. Fraudulent messages promising “expedited refunds” have circulated via text and email. The NYSDTF emphasized that it does not request personal information electronically.

“We’ve already flagged several phishing attempts,” said Commissioner Hiller. “If it doesn’t come in the mail from us directly, it’s not legitimate.”

Residents can verify authenticity through the official NYS Tax Department website or by contacting its helpline.