Veterans rated at 90 percent disability by the United States Department of Veterans Affairs (VA) are seeing higher monthly compensation following the 2.5 percent cost-of-living adjustment (COLA) that took effect on December 1, 2024. The increase, now reflected in all 2025 payments, aims to offset inflation and maintain veterans’ purchasing power.

Table of Contents

90% VA Disability Benefits

| Key Fact | Detail / Statistic |

|---|---|

| Cost-of-Living Adjustment (COLA) | 2.5 % increase effective Dec 1 2024 |

| 90 % base rate (no dependents) | $ 2,297.96 / month (2025) |

| 90 % with spouse (no children) | $ 2,489.63 / month |

| Projected 2026 COLA | ≈ 2.8 % |

| First payment under new schedule | January 2025 |

| Official Website | VA |

Understanding the November 2025 Update

The term “November 2025 VA benefit change” has circulated widely on veterans’ forums and social media. In practice, the adjustment stems from the December 2024 COLA, which began appearing in January 2025 payments.

Because VA compensation is paid one month in arrears, the payment arriving on December 1, 2025, reflects benefits for November and includes the ongoing 2025 rate.

Officials emphasize that no mid-year revision occurred. Instead, the November reference reflects the monthly payment cycle, not a separate policy decision.

The 2025 Cost-of-Living Adjustment

The 2.5 percent COLA is modest compared with the 8.7 percent record boost in 2023 and 3.2 percent in 2024, but it continues the federal government’s effort to align veterans’ compensation with inflation. The VA uses the same annual COLA formula as the Social Security Administration (SSA), based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

According to the Bureau of Labor Statistics, U.S. inflation cooled through 2024, stabilizing between 2 and 3 percent. The smaller COLA mirrors that trend, ensuring veterans’ payments keep pace with everyday expenses without over-adjusting for temporary price surges.

What Veterans with 90% Ratings Receive in 2025

Under the updated schedule:

- $ 2,297.96 per month – for veterans rated 90 % with no dependents

- $ 2,489.63 per month – for veterans with a spouse only

- $ 2,642.96 per month – with spouse + one child

- $ 2,797.13 per month – with spouse + two parents

- $ 2,807.12 – $ 2,900 + – ranges for larger families or those receiving special allowances

Veterans who qualify for Special Monthly Compensation (SMC)—such as those who are housebound, need aid and attendance, or have specific disabilities like loss of limb or vision—receive additional sums.

How Disability Ratings Are Determined

The VA assigns disability ratings from 0 to 100 percent in 10-point increments. Ratings reflect the severity of service-connected conditions and how much they reduce a veteran’s ability to earn income.

A 90 percent rating typically indicates multiple significant impairments—such as chronic orthopedic injuries, respiratory issues, or severe post-traumatic stress disorder (PTSD)—but not total disability.

Veterans at this level remain eligible to work but may face limitations in physical or mental capacity.

Combined Ratings and the “VA Math” System

Many veterans receive combined ratings for multiple conditions. The VA uses a non-linear formula often called “VA math,” which prevents simple addition. For example, two 50 percent ratings do not equal 100 percent; they combine to 75 percent.

Veterans frequently appeal combined ratings if they believe the VA undervalued their conditions.

Historical Comparison

The chart below illustrates how VA compensation has evolved for veterans rated at 90 percent over the past five years:

| Year | COLA | Monthly Base Payment |

|---|---|---|

| 2020 | 1.6 % | $ 1,833.62 |

| 2021 | 1.3 % | $ 1,857.96 |

| 2022 | 5.9 % | $ 1,967.39 |

| 2023 | 8.7 % | $ 2,172.39 |

| 2024 | 3.2 % | $ 2,242.41 |

| 2025 | 2.5 % | $ 2,297.96 |

The steady climb underscores how COLA adjustments serve as a safeguard against inflation rather than a raise in real income.

Broader Economic Context

Economists note that federal benefits such as Social Security, military retirement, and VA compensation play a crucial role in economic stability for millions of Americans.

Roughly 5.6 million veterans receive disability benefits. For many, it represents their primary income.

Dr. Michael Carver, an economist at the University of Maryland’s Center for Public Policy, said the 2025 adjustment “strikes a balance between inflation control and maintaining the living standards of veterans who depend on these payments.”

However, some advocacy groups argue that even a 2.5 percent increase lags behind regional housing and medical costs. The Disabled American Veterans (DAV) organization has called for Congress to explore more frequent cost reviews rather than relying solely on annual CPI calculations.

Understanding Dependents and Add-Ons

The VA bases compensation on family composition, acknowledging that dependents increase financial need.

Veterans may claim:

- A spouse,

- Children under 18,

- Children 18–23 attending school full-time,

- Or dependent parents.

Each dependent adds a small monthly supplement. Veterans must notify the VA of changes—such as marriage, divorce, or children aging out—to avoid over- or under-payment.

Outdated dependent information remains one of the leading causes of benefit miscalculations.

Veterans’ Reactions

Among veteran communities, reactions have been measured but generally positive.

Susan Martinez, a retired Army sergeant from Texas rated 90 percent for back injuries and PTSD, said the increase “won’t change my life, but it helps with groceries and fuel.”

Others express frustration that rising housing and healthcare costs outpace the federal formula.

Anthony Gibbs, a Navy veteran from Virginia, noted that “COLA doesn’t always reflect the costs we actually face, especially in cities where rents keep climbing.”

Advocates emphasize that while modest, consistent adjustments remain essential for financial security and morale.

Additional Financial Programs and Tax Implications

VA disability payments are non-taxable, distinguishing them from many other federal benefits.

Recipients may also qualify for:

- Property tax exemptions, depending on state law,

- VA healthcare priority group enhancements,

- Education benefits through the GI Bill,

- Vocational rehabilitation for job training and re-employment.

These programs often interconnect with disability ratings; a 90 percent rating can unlock partial access to benefits otherwise reserved for 100 percent disabled veterans.

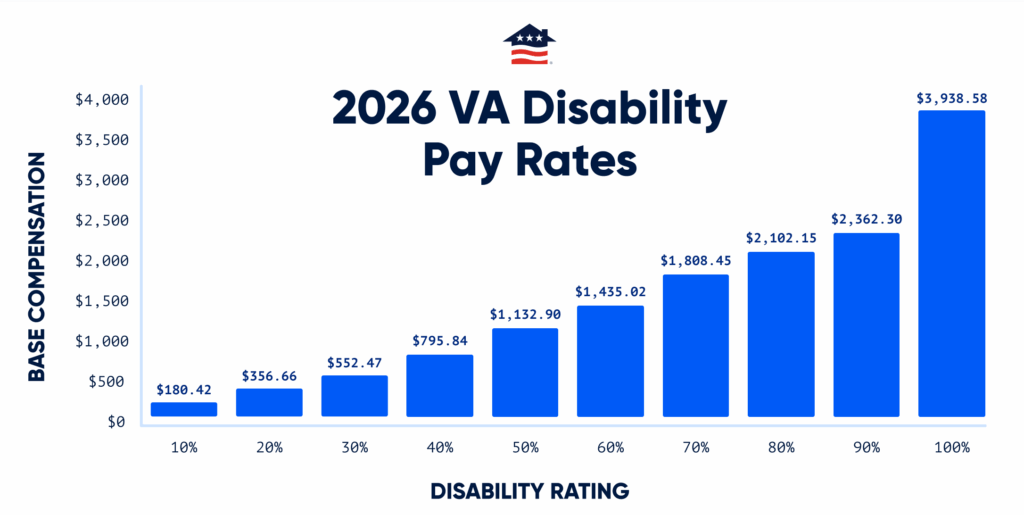

Future Outlook: 2026 and Beyond

The Social Security Administration projects a 2.8 percent COLA for 2026, pending final CPI-W figures from the third quarter of 2025.

If approved, new rates would take effect December 1, 2025, with payments distributed early January 2026.

Veterans’ organizations are also urging modernization of the VA’s digital systems to speed processing times and reduce backlogs. As of mid-2025, nearly 300,000 claims awaited review—down from more than 500,000 a year earlier.

Policy and Oversight

Congress continues to review broader VA reform measures, including mental-health coverage, toxic-exposure claims under the PACT Act, and automation of payment adjustments.

The House Committee on Veterans’ Affairs has held hearings urging the VA to streamline appeals and ensure transparency in COLA implementation.

Representative Maria Ellis (D-CA) stated in a September 2025 hearing that “accurate, timely payments are a moral obligation to those who served.”

Meanwhile, fiscal conservatives in Congress have cautioned against automatic increases without corresponding reviews of long-term sustainability.

How to Verify Your Payment

Veterans can confirm their updated compensation by logging into VA.gov or the VA Mobile App, where payment histories and dependent records are accessible.

The VA also mails annual benefit summaries and service-verification letters that show the current monthly amount.

Veterans who notice discrepancies should contact the VA Regional Office or a Veterans Service Officer (VSO) for assistance.

The Broader Impact of VA Compensation

Beyond individual households, disability compensation injects billions into local economies.

According to the Congressional Budget Office, VA payments exceeded $ 130 billion in 2024, with nearly half directed toward veterans with ratings of 70 percent or higher.

These payments support local spending on housing, healthcare, and small business activity—particularly in states with large veteran populations such as Texas, Florida, and California.

Common Challenges and Advice from Advocates

Veterans’ groups report frequent issues in three areas:

- Documentation Errors: Missing service records delay claims.

- Appeal Backlogs: Some appeals still take over a year.

- Under-rating: Many veterans believe their combined rating doesn’t fully reflect their impairments.

Organizations such as the American Legion, Veterans of Foreign Wars (VFW), and Disabled American Veterans (DAV) provide free assistance with filing or appealing claims.

Veterans are encouraged to avoid unverified “benefit consultants” who charge steep fees for services offered free through accredited VSOs.

Human Impact

For many, disability compensation is more than financial assistance—it is recognition of service and sacrifice.

Lt. Col. James Holloway (Ret.), who served three tours in Afghanistan, said, “Each increase reminds veterans that the government hasn’t forgotten us. It’s not just about the money; it’s about acknowledgment.”

Such sentiments highlight the symbolic value of consistent, transparent compensation.

Looking Ahead

The VA’s 2025 update demonstrates continued alignment between veterans’ benefits and national economic indicators.

While the COLA may appear modest, it reaffirms a broader principle: veterans’ incomes should not erode in real terms due to inflation.

The next adjustment, expected in 2026, will likely follow the same methodology, ensuring stability even as broader fiscal debates continue in Washington.

$5,000 Wells Fargo Settlement Payout – Key Dates, Eligibility, and How to Receive Your Money

$425M Capital One Settlement – Here’s How to Claim Before It’s Too Late

IRS Warning: Delays Explained for Millions Still Waiting on Inflation Checks- What You need to Know

FAQ About 90% VA Disability Benefits

1. When did the 2025 VA disability rates officially take effect?

They took effect on December 1, 2024, with the first payment at the new rate delivered in early January 2025.

2. Why do some sources call it a “November 2025” change?

Payments are made a month in arrears. The payment issued December 1, 2025, covers November, so some outlets label it that way. There was no mid-year policy change.

3. Are VA disability benefits taxable?

No. All VA disability compensation—including dependents and Special Monthly Compensation—is exempt from federal and state income tax.

4. Can I receive both VA disability and Social Security Disability Insurance (SSDI)?

Yes. They are separate programs with different eligibility rules. Receiving one does not disqualify you from the other.

5. How can I verify that I’m receiving the correct payment amount?

Check your account at VA.gov or in the VA Mobile App. If the figure doesn’t match your dependent status and rating, contact a Veterans Service Officer (VSO) immediately.