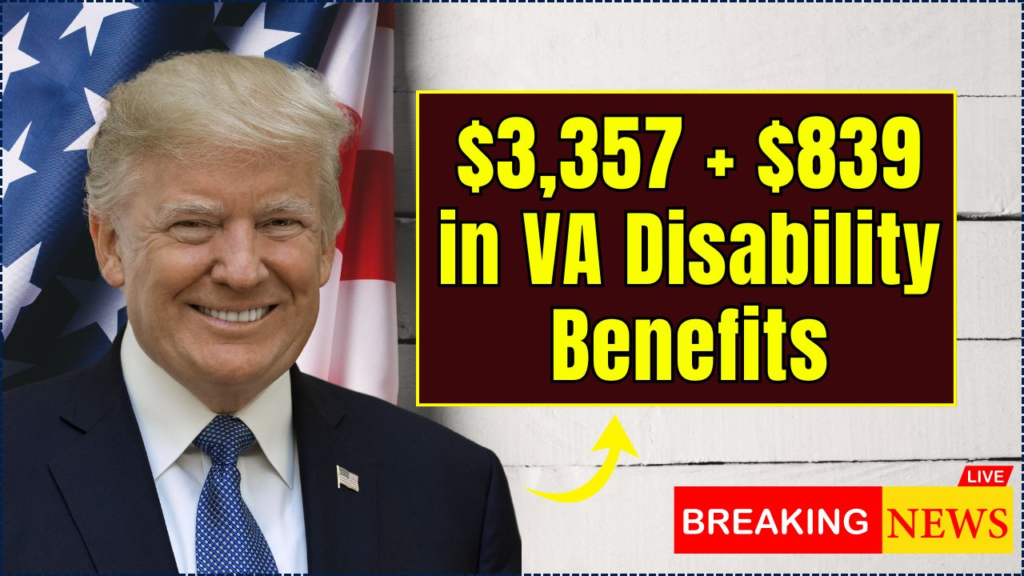

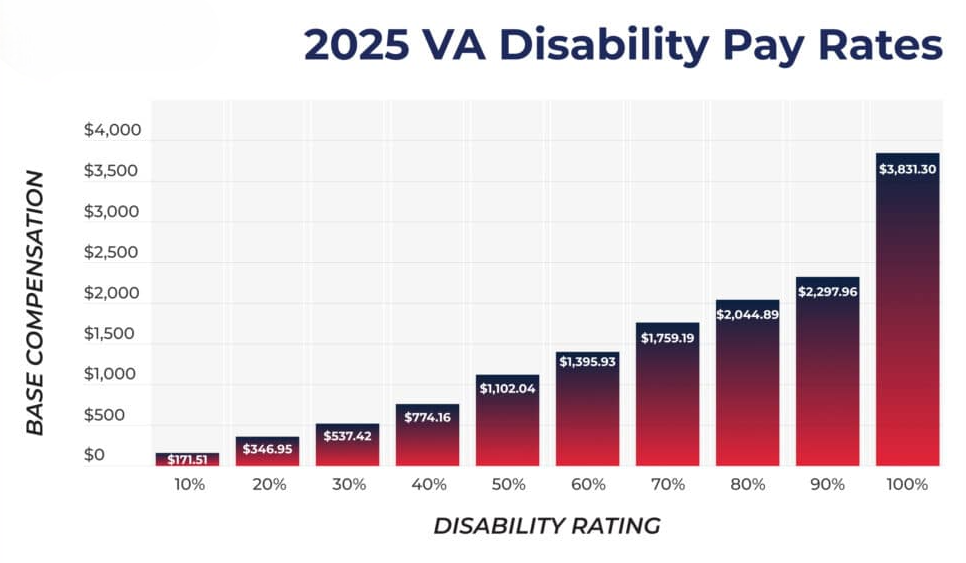

The U.S. Department of Veterans Affairs (VA) has released updated VA Disability Benefits rates for 2025, reflecting a 3.2% cost-of-living adjustment. Payments for eligible veterans now range up to $3,831.30 per month for a 100% disability rating, with additional compensation available for dependents and special circumstances.

Table of Contents

$3,357 + $839 in VA Disability Benefits

| Key Fact | Detail / Statistic |

|---|---|

| 2025 Cost-of-Living Adjustment (COLA) | 3.2% increase over 2024 rates |

| Maximum Monthly Payment (100% Rating, No Dependents) | $3,831.30 |

| Additional Dependent Benefit (Spouse, Child, or Parent) | +$100–$350 per dependent |

| Payment Schedule | First business day of each month |

| Official Website | U.S. Department of Veterans Affairs |

The 2025 update to VA Disability Benefits underscores the federal government’s continuing effort to support those who served.

While systemic challenges remain, ongoing reforms and technological modernization suggest a more efficient, equitable system ahead.

Understanding VA Disability Benefits

The VA Disability Benefits program provides monthly, tax-free payments to veterans whose physical or mental health conditions were caused or aggravated by military service. Each recipient is assigned a disability rating between 10% and 100% that determines the monthly payment amount.

Rates can increase for dependents such as spouses, children, or dependent parents, and for veterans with severe disabilities who require regular aid and attendance.

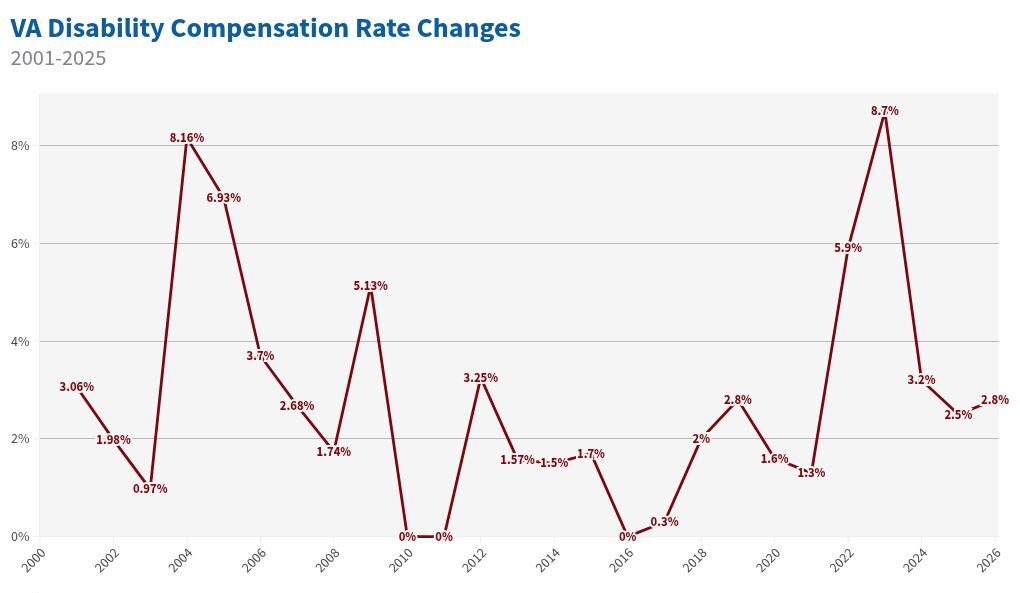

According to the Department of Veterans Affairs, the 2025 increase aligns with a 3.2% cost-of-living adjustment (COLA), mirroring Social Security benefits to protect veterans’ purchasing power against inflation.

“Each year, we adjust VA compensation to ensure that the value of veterans’ benefits keeps up with the cost of living,” said Denis McDonough, Secretary of Veterans Affairs.

Historical Context: How the Program Evolved

The VA’s compensation system traces its roots to 1917, when Congress created allowances for soldiers disabled during World War I. Over time, legislation expanded to cover new types of service-related injuries and illnesses, including mental health conditions that were long overlooked.

Following the Vietnam War, Agent Orange exposure became a turning point, prompting broader definitions of “service connection.” More recently, the Sergeant First Class Heath Robinson Honoring our Promise to Address Comprehensive Toxics (PACT) Act of 2022 marked a major reform, extending coverage to veterans exposed to burn pits and other toxic substances in Iraq, Afghanistan, and elsewhere.

“The PACT Act represents the most significant expansion of VA health care and benefits in decades,” noted Dr. Michael Kiser, a policy researcher at the RAND Corporation. “It reshaped how environmental exposure is treated in the disability framework.”

Who Qualifies for VA Disability Compensation

To qualify, veterans must show:

- A current illness or injury that affects their physical or mental health.

- Evidence that the condition was caused or aggravated by military service.

Claims are evaluated by the Veterans Benefits Administration (VBA) using service records and medical examinations. Disabilities may include orthopedic injuries, cardiovascular diseases, respiratory conditions, or psychological disorders such as post-traumatic stress disorder (PTSD) and depression.

Veterans with multiple disabilities receive a combined rating based on a complex formula rather than simple addition, meaning two 50% ratings do not equal 100%.

Case Study: Life After Approval

For James Daniels, a former Marine Corps sergeant from Texas, his 80% disability rating helped fund necessary medical devices and therapy. “The adjustment this year means I can finally cover my full rehabilitation costs,” Daniels said. “That’s not a luxury — that’s stability.”

Stories like Daniels’ are common. According to the VA’s Annual Benefits Report, nearly one in four U.S. veterans now receives some form of disability compensation.

How and When Payments Are Made

VA disability payments are deposited on the first business day of each month, covering the previous month’s entitlement.

If a payment date falls on a weekend or holiday, deposits are issued on the preceding business day.

For example, November 2025 benefits will be deposited Friday, October 31, since November 1 falls on a Saturday.

Payments are tax-free and available through direct deposit or the Veterans Benefits Banking Program (VBBP), which partners with banks and credit unions to provide low-cost financial services to veterans.

“Direct deposit is the fastest, safest, and most reliable way for veterans to receive their benefits,” a VA spokesperson confirmed.

Filing and Updating a Claim

Veterans can apply for benefits through VA.gov, by mail, or in person at a regional VA office. Many rely on Veterans Service Organizations (VSOs) like the American Legion or Disabled American Veterans (DAV) for assistance in preparing claims.

Processing typically takes 90 to 125 days, though complex claims may take longer. Applicants can track progress using the VA’s eBenefits portal.

If a condition worsens, veterans can submit a request for an increased rating. Supporting medical evidence is essential. Once approved, payments adjust retroactively to the date of the request.

Appeals and Legal Support

If a claim is denied, veterans can file an appeal with the Board of Veterans’ Appeals (BVA).

In 2024, nearly 40% of appeals were resolved in favor of veterans, according to VA data.

Legal experts encourage claimants to work with accredited attorneys or representatives, as professional advocacy often improves success rates. Appeals can take several months, but back pay covers the full period from the original filing.

Economic Impact and Federal Budget Context

The VA’s disability compensation program is among the largest federal entitlements, serving 5.7 million veterans nationwide.

In fiscal year 2025, total payments exceeded $140 billion, according to the Congressional Budget Office (CBO) — nearly double the amount paid a decade ago.

Economists note that these payments play a vital role in stabilizing local economies, particularly in rural and veteran-heavy regions.

“For many small towns, VA compensation is an economic anchor,” said Dr. Lisa Green, senior economist at the Pew Research Center. “It helps sustain families, small businesses, and community health systems.”

Challenges Ahead: Processing Delays and Digital Reform

Despite progress, the VA continues to face a backlog of pending claims. As of mid-2025, more than 325,000 cases awaited review, a 15% increase from 2023.

To address this, the agency has invested in artificial intelligence-assisted claim processing and digital medical record integration.

“Our modernization efforts are reducing errors and cutting decision times,” said Joshua Jacobs, VA Under Secretary for Benefits. “We expect significant improvements over the next two years.”

Analysts, however, caution that technological upgrades must be matched with staffing and training to ensure fairness and accuracy.

Future Outlook: The 2026 COLA and Beyond

The next cost-of-living adjustment will be announced in December 2025, based on the Consumer Price Index for Urban Wage Earners (CPI-W).

Early projections suggest a smaller increase, between 2.1% and 2.5%, if inflation continues to slow.

Policymakers are also evaluating new rules under the PACT Act that could expand eligibility for veterans exposed to environmental toxins at domestic bases.

“Our goal is simple: no veteran should have to fight twice — once for their country, and again for their benefits,” Secretary McDonough said in a statement.

IRS Warning: Delays Explained for Millions Still Waiting on Inflation Checks- What You need to Know

VA Boost: $3,500+ Monthly Payments Coming for Qualified Veterans in 2025

$5,000 Checks Coming Soon — Check If You’re Getting Paid This Week

FAQs About $3,357 + $839 in VA Disability Benefits

Can I work while receiving VA disability benefits?

Yes. Veterans rated below 100% may work without penalty. Those receiving Individual Unemployability (IU) benefits face restrictions if earnings exceed set thresholds.

Are VA disability payments taxable?

No. Benefits are fully tax-exempt at both federal and state levels.

What happens if my condition worsens?

You can request a rating increase at any time by submitting new medical evidence.

Do dependents automatically receive payments?

No. Dependents must be formally added to your claim for increased compensation.

Where can I get help with my claim?

Veterans can consult accredited VSOs or find legal representation through the VA Office of General Counsel’s accreditation database.