Widespread social media posts and viral articles recently claimed that the U.S. retirement age would leap to 75 years beginning November 2025. However, the SSA and independent fact-checkers say there is no law or regulation raising the retirement age to 75.

Instead, the only scheduled change is a small increase in the full retirement age for certain birth years.

Table of Contents

U.S. Retirement Age to Rise to 75+ Starting

| Key Fact | Detail |

|---|---|

| Full retirement age for those born in 1959 | 66 years and 10 months (effective Nov 2025) |

| Full retirement age for those born in 1960 or later | 67 years |

| Earliest age one can claim benefits | 62 years (with reduced benefits) |

| No valid change to age 75 | Rumour; not backed by SSA or by Congress |

| Maximum monthly benefit at FRA in 2025 (for high earners) | ~$4,018 per month |

Why the Misleading Claim of “Age 75”

Origins of the Rumour

The idea that retirement age would jump to 75 appears to stem from social-media posts and misleading article headlines. These repeatedly cite unspecified “new laws” or “policy changes starting November 2025” without referencing legislative text or agency guidance. In contrast, the SSA’s FAQ states the FRA schedule remains unchanged for age-75 levels.

Why the Rumour Spreads Easily

- Demographic pressure – As life expectancy grows and the ratio of retirees to workers rises, many Americans believe a dramatic change is inevitable.

- Complexity of policy – The phased increase to FRA makes it easy to misinterpret or generalise.

- Click-bait headlines – Some websites amplify shocks (“retirement age pushed to 75”) even where underlying facts are limited.

- Genuine reform discussion – Experts and policymakers are discussing raising the retirement age further in future decades, which may falsely be interpreted as imminent. For example, commentators have noted that several OECD countries link retirement age to longevity.

What Is Actually Changing in November 2025

The Modest FRA Increase

Under the SSA’s schedule:

- If you were born in 1959, your full retirement age rises to 66 years and 10 months.

- If you were born in 1960 or later, your FRA will be 67 years.

- The earliest you can claim remains 62, which brings a permanently reduced monthly benefit.

Why the Change

This increase reflects a policy that began with the Social Security Amendments of 1983 (under Ronald Reagan), which gradually raised the FRA from 65 to 67 over decades. The goal was to reflect rising life expectancy and reduce the fiscal strain on the Social Security program.

Other 2025-26 Related Adjustments

While the FRA increase is small, other related changes include:

- A cost-of-living adjustment (COLA) of 2.5% in 2025 for beneficiaries.

- The earnings limit for those working while filing early benefits is adjusted.

- Maximum taxable earnings (for Social Security payroll tax) also rise.

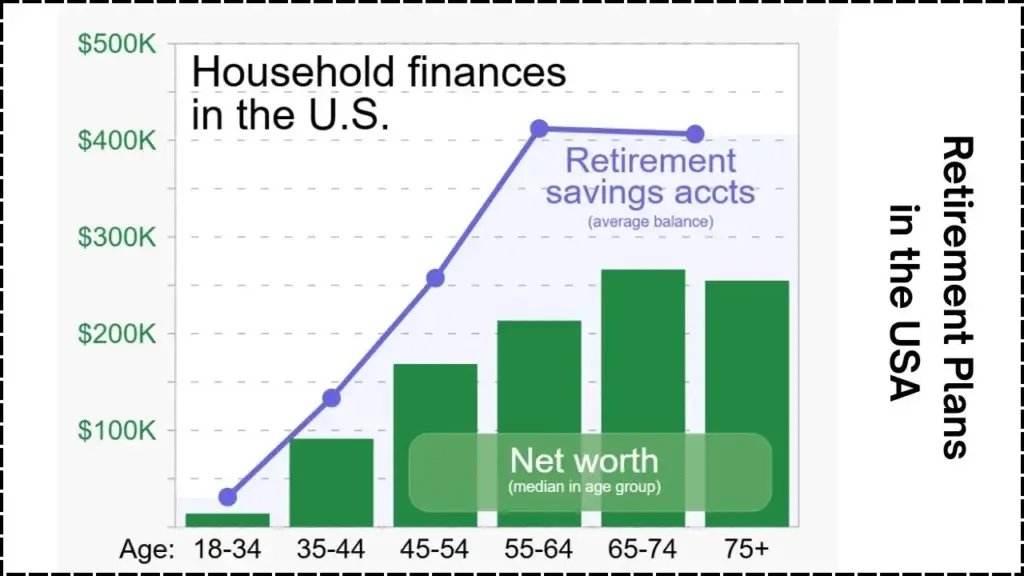

The Broader Financial and Demographic Context

Funding Challenges for Social Security

The U.S. Social Security trust fund faces long-term pressure. According to the 2026 outlook, the trust fund is projected to become depleted in the mid-2030s if no reform is undertaken. Then, unless changes are made, benefits could be automatically cut by roughly 20 %.

Why Retirement Age is Part of the Conversation

Several experts note that increasing the retirement age further (for younger generations) is among the possible policy levers. As noted by Dr. Alicia Munnell of the Center for Retirement Research at Boston College:

“Incremental increases tied to life expectancy are possible, but 75 is not on the table.”

(This was quoted in coverage of pension-system reform.)

Other countries already link retirement age to longevity, and the U.S. may face similar discussions.

What the Policy Trade-Offs Are

- Raising the full retirement age reduces government spending but can penalise workers in physically demanding jobs and those with shorter life expectancies.

- Keeping the age lower supports earlier retirement but increases pressure on younger workers and the federal budget.

- Alternative reforms include increasing payroll taxes, adjusting benefit formulas, or indexing benefits to longevity.

How This Affects Different Groups

Current Near-Retirees (Born before ~1960)

If you’re born in 1959: You will need to reach 66 years and 10 months for full benefits in 2025. If you were born in 1960 or later: full benefits at 67. If you claim earlier (at age 62), you’ll receive a permanently reduced monthly benefit.

Younger Workers (Born in 1960s and Beyond)

While the FRA is 67 for those born in 1960 or later, future reforms are possible. Working longer, saving more and planning for changes may be prudent.

Workers in Physically Demanding Roles

Proposals to raise retirement age further pose unique challenges for those in jobs with physical strain or health issues. They may be unable to continue working into later ages.

Financial-Planning Implications

- Delaying benefit claims beyond full retirement age (up to age 70) increases monthly benefit via “delayed retirement credits.”

- Regular review of retirement savings, health care costs and life expectancy is advised.

- Verify any information using the SSA website rather than relying on viral posts.

What to Watch Going Forward

Legislative Signals

While no change to age 75 is pending, Congress is holding hearings on potential reforms, including the possibility of indexing FRA to longevity or raising the age further for younger cohorts.

Next Trustees Report

The SSA’s next annual trust-fund report (mid-2026) will provide updated projections on program solvency and may influence policy direction.

Individual Action

Experts recommend:

- Periodic check of your SSA statement (via “my Social Security” account) to understand your benefit estimate.

- Consider factors such as health, life expectancy, job satisfaction and savings in retirement timing.

- Understand that while the FRA is rising gradually, no immediate jump to 75 has been approved.

Related Links

VA Boost: $3,500+ Monthly Payments Coming for Qualified Veterans in 2025

IRS Warning: Delays Explained for Millions Still Waiting on Inflation Checks- What You need to Know

Final Outlook

The rumor of a U.S. retirement age rising to 75 in November 2025 is unfounded. The only scheduled change is a modest shift in the full retirement age to 66 years 10 months for those born in 1959 and to 67 for those born in 1960 or later. As the Social Security program comes under demographic and fiscal pressure, further reforms may be proposed — but none at such a dramatic threshold have been enacted. For now, Americans should rely on verified SSA updates and craft retirement plans accordingly.

FAQ About U.S. Retirement Age to Rise to 75+ Starting

Q: Will I have to work until age 75 to receive full Social Security benefits?

No. The full retirement age is currently being phased up to 67 for those born in 1960 or later. The “age 75” claim is not supported by law or agency guidance.

Q: Can I still retire at age 62?

Yes — you may claim retirement benefits as early as age 62, but your monthly benefit will be permanently reduced.

Q: Will there be further increases in full retirement age?

No further scheduled increase to age 75 has been approved. However, future legislative reforms could raise the FRA for younger generations. Experts say nothing immediate is imminent.