Speculation about $2,000 “tariff-funded stimulus checks” has surged online after former President Donald Trump floated the idea of returning tariff revenue to American taxpayers. While the proposal has generated significant attention, officials emphasize that no such payments are currently authorized or scheduled.

Table of Contents

$2,000 Tariff-Funded Stimulus Checks

| Key Fact | Detail |

|---|---|

| Proposed Payment | $1,000–$2,000 per adult, funded by import tariffs |

| Legislative Vehicle | American Worker Rebate Act (2025 proposal) |

| Payment Status | No official approval or timeline; rumors unverified |

| Possible Administrator | Internal Revenue Service (IRS), if enacted |

What Is the Tariff-Funded Stimulus Proposal?

The idea of $2,000 tariff-funded stimulus checks stems from comments made by Donald Trump during a campaign interview earlier this month. He suggested using tariff revenues from foreign imports—particularly those from China—to fund direct payments to U.S. citizens.

“We’re looking at maybe $1,000 or $2,000 for hardworking Americans, paid for entirely by tariffs,” Trump said. “That money comes from countries that have been taking advantage of us.”

The concept echoes populist themes central to Trump’s previous trade policy, which emphasized tariffs as a tool to protect domestic industries and rebalance global trade. However, while tariffs do generate revenue, they also tend to increase consumer prices and can prompt retaliatory measures from trading partners.

The American Worker Rebate Act: The Policy Framework

Introduced in 2025 by Senator Josh Hawley (R-MO), the American Worker Rebate Act would establish a permanent system of annual rebate payments funded through tariff income. Under the proposal, individuals would receive at least $600, and families could receive up to $2,400 per year.

Hawley argues that the system would ensure that “ordinary Americans, not Washington bureaucrats or foreign corporations,” benefit from trade policy.

“For decades, trade deals have hollowed out our industrial base,” Hawley said in an official statement. “Tariff revenue should go back to the workers who made this country strong.”

Economists note that while the bill highlights an innovative funding source, its feasibility depends on trade conditions. Tariff revenues fluctuate based on import volumes and global demand, making them an unstable long-term funding base.

No Law, No Checks — Yet

Despite growing public interest, the Internal Revenue Service (IRS) and Department of the Treasury have issued no announcements about any forthcoming payments. The proposal remains at the legislative stage, with no congressional approval or budget allocation.

Rumors suggesting checks could “arrive by November” have been traced to viral social media posts that misrepresented Trump’s remarks. Fact-checkers from Reuters, Associated Press, and Snopes confirm there is no list, no enrollment process, and no official payment timeline.

“Any website claiming you can ‘apply’ for a $2,000 tariff rebate should be treated as suspicious,” said Lina Khan, Chair of the Federal Trade Commission (FTC). “Scammers exploit misinformation to collect personal and financial data.”

Economic Context: The Return of Trade Politics

The tariff-rebate idea comes amid persistent economic unease. Although U.S. inflation has cooled to around 2.7%—down from 6.5% in 2022—wages have not kept pace with rising living costs, according to data from the U.S. Bureau of Labor Statistics (BLS). Public sentiment surveys show continued anxiety over affordability, housing, and healthcare.

Supporters say returning tariff proceeds to citizens could stimulate spending without deepening the deficit. Critics argue that tariffs function as indirect taxes on consumers, since importers often pass higher costs to retailers and households.

“It’s politically clever but economically contradictory,” said Dr. Sarah Binder, senior fellow at the Brookings Institution. “You can’t simultaneously tax imports and claim to make consumer goods cheaper.”

Historical Comparison: From Pandemic Stimulus to Tariff Rebates

The U.S. government issued three rounds of stimulus checks between 2020 and 2021 under the CARES Act and subsequent relief packages. Those payments were financed by federal borrowing, not trade revenue. The tariff-funded model represents a shift toward using existing revenue streams rather than deficit spending.

“It’s a novel idea,” said Jason Furman, former chair of the Council of Economic Advisers under President Obama. “But unlike pandemic relief, tariff-based rebates depend on the size of imports. If trade slows, so does funding.”

Experts note that even if the bill passes, administrative preparation could take months, making widespread payments before the end of 2025 unlikely.

The Politics Behind the Promise

The proposed rebate aligns with Trump’s broader campaign message focused on “America First” economic policies. Political analysts say the idea resonates with voters who benefited from previous stimulus rounds but remain frustrated with inflation and inequality.

“It’s an election-year message that blends fiscal populism and trade nationalism,” said Dr. Elaine Kamarck, senior fellow at the Brookings Institution. “Whether it’s fiscally sound is another question.”

Democratic lawmakers, including Senator Elizabeth Warren (D-MA), have voiced skepticism, arguing that tariff-funded checks could “disguise the true costs of trade wars” while failing to address deeper issues such as wage stagnation and corporate pricing power.

Potential Implications and Next Steps

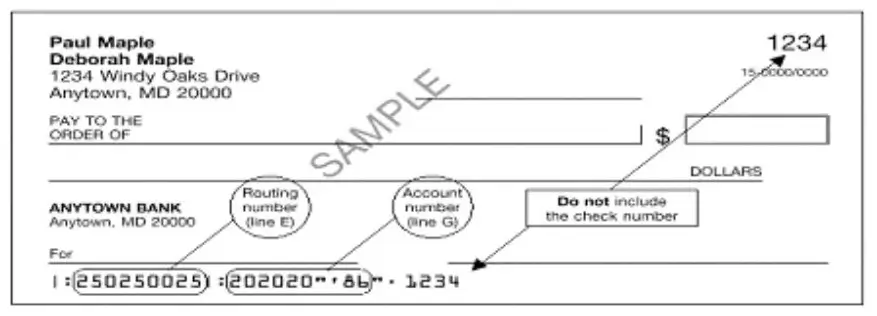

Should Congress advance the bill, the U.S. Treasury Department would likely direct the IRS to administer payments, similar to how prior stimulus checks were distributed. Implementation could involve updating payment systems, verifying taxpayer data, and defining eligibility thresholds.

However, without bipartisan consensus and an enacted budget measure, the timeline remains speculative. Analysts warn that public expectations for “November checks” are unrealistic.

“Even in a best-case scenario, implementation would extend well into 2026,” said Dr. William Gale, co-director of the Tax Policy Center. “Fiscal policy moves slower than campaign rhetoric.”

Disinformation Warnings and Public Guidance

The FTC and Better Business Bureau (BBB) have issued consumer advisories urging Americans to verify any communication claiming eligibility for new stimulus programs. Official updates will appear only on IRS.gov or Treasury.gov, both of which maintain strict security and privacy standards.

To avoid fraud:

- Do not click on unsolicited links or “eligibility checkers.”

- Do not share Social Security numbers or banking information with unverified entities.

- Follow official news from the IRS, Congress.gov, and major wire services for confirmed policy developments.

Related Links

$425M Capital One Settlement – Here’s How to Claim Before It’s Too Late

IRS Warning: Delays Explained for Millions Still Waiting on Inflation Checks- What You need to Know

The Bottom Line

As of late October 2025, no tariff-funded stimulus payments have been approved. The idea remains under discussion in Congress, with the American Worker Rebate Act serving as its legislative foundation.

While the concept has strong populist appeal, experts caution that transforming tariffs into recurring household income would require both congressional authorization and significant administrative planning—making any November rollout implausible.

“Until legislation is passed, there is no list, no schedule, and no money on the way,” said Treasury analyst Dana Peterson. “Americans should rely on official sources, not viral posts.”