Canada Raising OAS Age to 67: Canada is making a big move that’s gonna shake up retirement plans all across the country. The government announced that starting in 2025, the age when you can start collecting Old Age Security (OAS) benefits will go up from 65 to 67. Yup, that’s right — you’ll now have to wait two extra years before Uncle Sam’s Canadian cousin starts sliding that monthly pension into your account. This change is a big deal, especially if you were planning to kick back and enjoy your golden years starting at 65. Why the change? Life expectancy has been going up, and a growing number of seniors means more mouths to feed for the pension system. So the government’s tightening the rules to keep the program alive and kicking for future generations. Let’s break it down in plain English what this means for you, how to plan ahead, and what smart moves you can make to dodge any financial curveballs.

Table of Contents

Canada Raising OAS Age to 67

Raising the Old Age Security age to 67 starting in 2025 is a major shift in Canadian retirement. It helps keep the program financially sound but also means you have to take charge of your retirement strategy more than ever.

- Save more cash today.

- Plan your claiming decisions strategically.

- Know your job and health realities.

- Get expert advice tailored to your life.

- Check government programs supporting seniors’ income.

Doing your homework now ensures a chill, financially secure retirement down the road.

| Topic | Details |

|---|---|

| OAS Eligibility Age | Raising from 65 to 67 starting in 2025 |

| Affected Groups | Canadians born April 1, 1960, or later (current recipients not impacted) |

| Reason for Change | Aging population & long life expectancy putting strain on OAS budget ($60B expected in 2025) |

| Options for Retirees | Delay benefits to increase monthly payouts or claim early with reduced benefits |

| Impact | May require savings adjustments or delayed retirement plans |

| Global Context | Similar age hikes happening in the US, UK, and Australia |

| Support for Vulnerable | Government initiatives for low-income seniors and Indigenous communities |

| Official Info | For more details, check Canada Government OAS Information |

A Quick History of Old Age Security in Canada

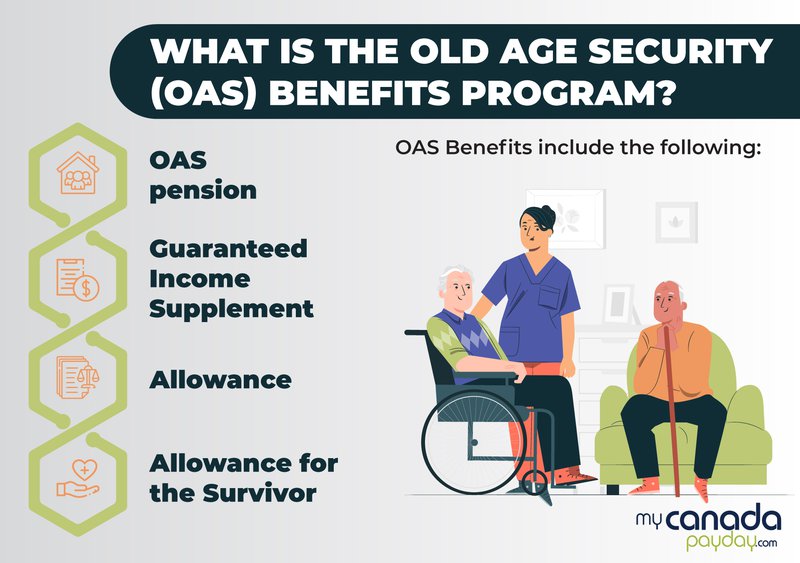

The Old Age Security program has been helping Canadian seniors since 1952. It was created as a foundational income source for people aged 65 and older. For decades, 65 was the golden age to start enjoying these benefits, with some tweaks along the way to keep things sustainable.

This recent decision to raise the eligibility age to 67 is one of the biggest changes in years, reflecting the need to adapt to new realities like longer life spans and changing demographics. The program’s goal remains the same: providing financial support to seniors while ensuring the system lasts for future Canadians.

Why is Canada Raising OAS Age to 67?

People are living longer and healthier lives than ever before. That’s fantastic, but it also means pensions are being paid out for more years than originally expected. Here’s the deal: if folks retire at 65 and live into their 80s or 90s, the government ends up paying benefits for 20+ years, which strains the system’s finances.

By moving the OAS eligibility to 67, the government shortens that payout period, helping save billions and keep the system afloat. In 2025 alone, the OAS program is expected to cost around $60 billion, up from $52 billion in 2020.

And this isn’t a Canada-only story — the U.S., the U.K., and Australia have also raised their retirement ages to 67 or beyond, balancing longer life expectancies with sustainable pension spending.

What Canada Raising OAS Age to 67 Means for Your Retirement Plans?

If you’re born after April 1, 1960, and plan to rely on OAS, you’ll have to:

- Wait two extra years before receiving full government pension payments.

- Adjust financial strategies to cover this gap—whether by saving more or working longer.

- Consider claiming early benefits from age 60 with reduced payments; or delaying benefits past 67 to increase monthly checks by about 0.7% per month delayed (up to 36% more at 70).

- Understand that those already receiving OAS or close to 65 are not affected by this change.

Who Qualifies for OAS Besides Age?

You also need to be a Canadian citizen or legal resident and must have lived in Canada at least 10 years since age 18 to get partial OAS if living in Canada. If you live outside Canada, the requirement is 20 years since age 18. It doesn’t matter if you worked or never worked—eligibility depends on residence history and citizenship.

Additionally, certain Canadians working abroad may count that time toward residency for OAS under specific conditions.

Practical Tips to Smooth the Transition

1. Crunch The Numbers With Accurate Tools

Use the Government of Canada OAS calculator or other trusted retirement planners to see how this change affects your benefits timeline and amount.

2. Pad Your Savings Buffer

Since OAS payments start later, it’s smart to increase contributions to your RRSPs, TFSAs, or other retirement investments. The more you save now, the easier bridging the gap will be financially.

3. Consider Your Job Realities

If you’re in a physically demanding job, it might be tough to keep working longer. Look into provincial or federal programs that assist older workers or explore retraining options for less strenuous roles.

4. Get Professional Guidance

A certified financial planner can guide you on strategies like when to claim OAS or CPP, tax optimization, and investment planning to maximize your income in retirement.

5. Check Out Other Supports

Low-income seniors might qualify for the Guaranteed Income Supplement (GIS), which provides additional $$ support. Be sure to check if you qualify and apply early.

How Does Delaying Your OAS Affect Your Payments?

Here’s a key fact: For every month you delay receiving OAS after age 65 (or now 67 for new eligibility), your pension increases by 0.6%. If you delay up to age 70, your monthly amount grows up to 36% more than if you started at 65. This means waiting can pay off, literally.

Impact on Vulnerable Groups and Indigenous Communities

This change may hit low-income seniors and Indigenous populations harder due to health, employment, and financial challenges. The government recognizes these concerns and has promised ongoing consultations to address fairness and support for these communities. Programs like GIS and other income-tested benefits remain vital lifelines.

Understanding the Claiming Process — Step by Step

- Check Your Eligibility: Must be 67 years old if born after April 1, 1960.

- Decide When to Apply: You can apply up to 11 months before your 67th birthday.

- Submit an Application: Through Service Canada, online or by mail.

- Know Your Payment Amount: Depends on your claiming age.

- Set Up Payment: Payments go monthly by direct deposit.

- Keep Info Updated: Notify Service Canada about changes to your address or marital status.

Political and Social Perspectives

The move to raise retirement age has its supporters praising fiscal responsibility and adapting to today’s realities. Critics worry about those in tough jobs and vulnerable groups. Advocacy groups are calling for exemptions or flexible retirement paths to soften the blow.

How This Change Fits With CPP?

Alongside OAS, Canada is increasing the Canada Pension Plan (CPP) full benefit age to 67. Delaying CPP past 65 boosts your monthly checks substantially, just like with OAS. Combined, these changes mean Canadians should rethink when and how to start claiming government pensions for best financial outcomes.