The CRA Student Grants and Loans 2025 program, launched under the federal Canada Student Financial Assistance Program (CSFAP), introduces updated eligibility rules, higher grant limits, and continued zero-interest loans for the 2025-26 academic year. The initiative aims to make post-secondary education more affordable for Canadian students amid rising tuition and living costs across the country.

Table of Contents

CRA Student Grants and Loans 2025

| Key Fact | Detail / Statistic (2025-26) |

|---|---|

| Full-time student grant | Up to $525 per month of study |

| Part-time student grant | Up to $2,520 per academic year |

| Loan limit (weekly) | $300 per week of study |

| Income threshold (single) | Up to $36,811 for maximum grant |

| Interest on loans | Permanently eliminated (since 2023) |

| Official Website | Canada.ca |

What’s New in the CRA Student Grants and Loans 2025 Program

The CRA Student Grants and Loans 2025 framework under the Canada Student Financial Assistance Program (CSFAP) introduces updated thresholds and maintains enhanced grant levels for the 2025–26 academic year. The changes were formalized in April 2025 through the Canada Gazette.

According to Employment and Social Development Canada (ESDC), the aim is to “ensure post-secondary education remains within reach for Canadians as living costs rise.” Federal grants remain double their pre-pandemic amounts, with full-time students eligible for up to $525 per month and part-time students for up to $2,520 annually.

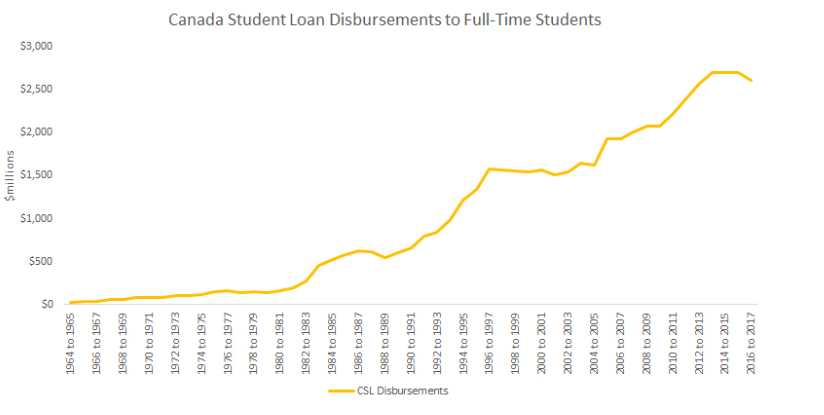

From 1964 to the Digital Era

Canada’s federal student aid system dates back to 1964, when the first Canada Student Loans Act established a national framework to share education costs between individuals and government. Over time, new grants were introduced to help low-income families, Indigenous learners, and students with disabilities.

During the COVID-19 pandemic, Ottawa temporarily doubled grant amounts to ease financial pressure. Initially a short-term measure, the enhancement was extended multiple times and is now embedded into the 2025-26 academic framework. Analysts say this marks the most significant federal investment in student aid in decades.

Eligibility Criteria for 2025-26

To qualify for CRA Student Grants and Loans 2025, applicants must:

- Be a Canadian citizen, permanent resident, or protected person.

- Reside in a participating province or territory (all except Quebec, Northwest Territories, and Nunavut).

- Enrol in a designated post-secondary institution in an approved program.

- Demonstrate financial need through standardized income and expense assessments.

Additional funding remains available for students with disabilities, dependants, or those pursuing part-time studies.

“Our updated criteria reflect both equity and the real costs of education across Canada,” said Janet Walcott, Director of Policy at ESDC, in a policy briefing.

Grants and Loan Details

Federal Grants

- Full-time students: Up to $525 per month of study, for those meeting low- and middle-income thresholds.

- Part-time students: Up to $2,520 per academic year, depending on assessed need.

- Students with dependants: $280 per child per month.

- Students with disabilities: Up to $4,000 annually for education and accommodation supports.

Loans

The Canada Student Loan program continues to provide repayable assistance. The weekly loan cap remains $300 per week of study. Borrowers benefit from a zero-interest policy, made permanent in April 2023. Repayment starts six months after leaving school, with flexible income-based repayment plans.

Application and Payment Process

Students apply through their provincial or territorial student aid offices, which administer both federal and regional funding. Applications typically open in the spring for the following academic year. Funds are disbursed directly to institutions or student accounts at the start of each term.

“Processing times have improved thanks to digital integration with the National Student Loans Service Centre (NSLSC),” said Eric Lamontagne, NSLSC spokesperson.

Approximately 1.7 million students received federal or combined aid in 2024–25, according to ESDC data. The government expects a similar figure this year.

Income Thresholds and Financial Assessment

Eligibility for maximum grant amounts depends on family size and gross income. For 2025–26, a single student earning $36,811 or less qualifies for full support, with tapering benefits above that level.

Thresholds are indexed annually to inflation to ensure consistency with cost-of-living changes.

| Family Size | Maximum Annual Income for Full Grant | Grant Phase-Out Limit |

|---|---|---|

| 1 | $36,811 | $68,324 |

| 2 | $52,583 | $97,583 |

| 3 | $64,113 | $116,121 |

| 4 | $73,808 | $131,256 |

Human Impact: Students Feel Relief but Costs Still Bite

For many students, the grants provide essential breathing room.

Sarah Li, a third-year sociology student at the University of British Columbia, said the assistance “means I can focus more on my coursework instead of taking two part-time jobs.”

Others, like Ethan Moreau from Calgary, say housing costs still strain budgets: “The grants help, but rent has doubled since I started university. It’s still a constant calculation.”

These voices echo national survey results from Universities Canada, showing that nearly 60% of undergraduates rely on some form of government aid.

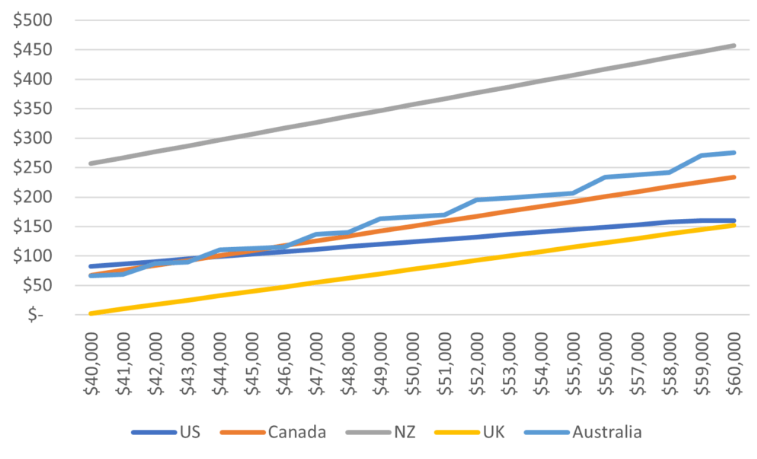

Comparing Canada’s Approach Internationally

Canada’s system stands out among OECD nations for combining non-repayable grants with income-based loan repayment.

In contrast, U.S. students face higher average debts — roughly US$29,000, according to the Federal Reserve — and accrue interest immediately after graduation.

The U.K. model links repayment strictly to income but charges inflation-linked interest rates.

“Canada’s hybrid model provides a fairer balance between public investment and personal responsibility,” said Dr. Michael Chen of the Canadian Centre for Policy Alternatives (CCPA).

Tax Benefits and Repayment Relief

Borrowers may claim a non-refundable tax credit for interest paid on provincial loans (federal interest is now zero).

The Repayment Assistance Plan (RAP) caps payments at affordable levels — usually no more than 20% of household income.

If income falls below certain thresholds, repayment can be temporarily paused without penalty.

“These measures collectively support financial stability for graduates entering a tough job market,” said Dr. Sarah Pelletier, education economist at McGill University.

Broader Policy and Economic Context

Education analysts note that while expanded grants help offset tuition, the rising cost of living — particularly rent — continues to challenge students.

The Canadian Federation of Students (CFS) has called for further increases and for a long-term National Student Housing Strategy.

Economists also highlight that reducing student debt contributes to long-term economic stability.

“Graduates with lower debt loads are more likely to buy homes and start businesses,” said Dr. Ravi Dhillon of the University of Toronto’s Munk School of Global Affairs.

Future Outlook

The federal government is expected to review program funding again in 2026, potentially adjusting grant levels to inflation and exploring AI-driven assessment tools for faster application processing.

Officials are also studying partnerships with Indigenous Services Canada to improve access for First Nations and Métis students.

“We must modernize the delivery of student aid to match the needs of a digital generation,” said Minister of Employment, Workforce Development and Official Languages Randy Boissonnault in an April 2025 briefing.

Canada Advances Quantum Error Correction Techniques for Scalable Quantum Computing

Canadian Scientists Just Cracked a Major Quantum Problem — Say Hello to Smarter Qubits

FAQ

1. Who qualifies?

Canadian citizens, permanent residents, and protected persons in approved programs who demonstrate financial need.

2. What’s new in 2025?

Enhanced grant limits ($525/month), updated income thresholds, and continued zero-interest loans.

3. How do students apply?

Through their province or territory’s online student aid portal.

4. When are funds paid?

At the start of each academic term, usually directly to the institution or student.

5. Will grant amounts change in 2026?

The federal review may adjust amounts to reflect inflation or tuition changes.