BTQ Launches Quantum-Safe Framework: The world of digital finance is changing fast, and one of the biggest new challenges is keeping our money safe from the next generation of cyber threats. Today, BTQ Technologies Corp. has taken a major step forward by launching the Quantum Stablecoin Settlement Network (QSSN)—a groundbreaking framework designed to protect stablecoins from the looming risks of quantum computing.

In this article, we’ll break down what this means, why it matters, and how it could shape the future of money for everyone—from 10-year-olds learning about digital cash to professionals managing billions in assets.

BTQ Launches Quantum-Safe Framework

| Feature/Stat | Details |

|---|---|

| Official Website | BTQ Technologies |

| What Launched | Quantum Stablecoin Settlement Network (QSSN) |

| Purpose | Protect stablecoins from quantum computing cyber threats |

| Market Size | Global stablecoin market exceeds $225 billion |

| Supported Stablecoins | Circle (USDC), Tether (USDT), JPMorgan’s USD deposit token (JPMD), Fire Labs, others |

| Regulatory Alignment | Meets evolving U.S. and global quantum-safe requirements (e.g., NIST, NSA CNSA 2.0) |

| Technology | Dual-signature (ECDSA + Falcon-512), BTQ’s proprietary CASH hardware |

| User Impact | No change to user experience or workflows |

| Professional Impact | Enables banks, payment firms, and digital asset platforms to future-proof their infrastructure |

| Demonstrated Use Case | JPMorgan’s USD deposit token (JPMD) |

The launch of BTQ’s Quantum Stablecoin Settlement Network marks a turning point in the fight to secure digital money against tomorrow’s cyber threats. By combining quantum-safe cryptography, hardware security, and seamless integration, QSSN gives banks, payment companies, and digital asset platforms the tools they need to protect their stablecoins—now and in the quantum future. As quantum computing draws closer, preparing today is the smartest move for anyone who cares about the safety and stability of digital finance.

What Are Stablecoins and Why Are They Important?

Stablecoins are a type of digital currency that are designed to keep a steady value—usually by being tied to something stable, like the US dollar. Popular examples include USDC (by Circle) and USDT (by Tether). They’re used for everything from buying things online to sending money across borders in seconds. As of June 2025, the stablecoin market has grown to more than $225 billion.

Stablecoins are becoming a critical part of the global financial system. Banks, payment companies, and even governments are using them for faster, cheaper, and more transparent transactions. For professionals, stablecoins offer a way to move money 24/7, settle trades instantly, and unlock new business models.

The Quantum Threat: Why Do We Need Quantum-Safe Stablecoins?

Today’s digital money relies on cryptography—a kind of secret code that keeps your money safe. But scientists are building quantum computers—super-powerful machines that could, one day, break these codes in seconds. If that happens, hackers could forge transactions, steal funds, or even destroy trust in digital money.

Governments and experts are warning that we need to get ready now. In June 2025, the White House issued an executive order urging all critical financial infrastructure to upgrade to quantum-safe cryptography. The NSA and NIST have set standards for what this means, and new laws are coming that will require banks and digital asset firms to comply by 2030.

How Does BTQ’s Quantum Stablecoin Settlement Network (QSSN) Work?

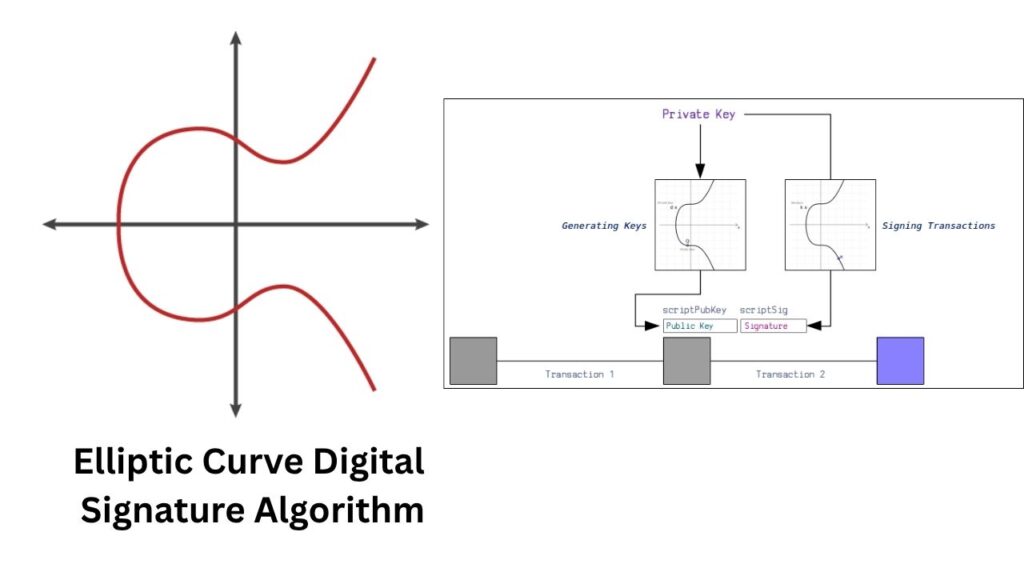

1. Dual-Signature Security

QSSN uses a clever system of dual signatures for the most sensitive stablecoin operations—like minting new coins, burning (destroying) coins, and changing key settings. Every important transaction is signed with:

- ECDSA: The standard digital signature used today.

- Falcon-512: A quantum-safe signature that even quantum computers can’t crack.

This means even if quantum computers become powerful enough to break current codes, your stablecoins will still be protected.

2. BTQ’s Proprietary CASH Hardware

All these signatures are generated using BTQ’s CASH hardware. This is a special device that keeps the most important cryptographic keys locked away, safe from hackers and quantum attacks.

3. No Disruption to Users

One of the best things about QSSN is that it doesn’t change how you use stablecoins. Whether you’re a kid sending your allowance or a bank moving millions, your experience stays the same. All the quantum-safe magic happens behind the scenes.

4. Regulatory Ready

QSSN is built to meet the latest government and industry standards for quantum safety. This includes U.S. federal mandates and international guidelines, ensuring that banks and payment companies can stay compliant as the rules evolve.

Why Is This a Big Deal for Professionals and Institutions?

A. Future-Proofing Financial Infrastructure

Banks, payment companies, and digital asset platforms are under pressure to upgrade their systems before quantum computers arrive. QSSN gives them a way to do this quickly and effectively, without disrupting their business or their customers.

B. Supporting All Major Stablecoin Models

QSSN isn’t just for one type of stablecoin. It supports:

- Fiat-backed stablecoins (like USDC and USDT)

- Bank-issued stablecoins (like JPMorgan’s USD deposit token)

- Real-world asset tokens (like tokenized gold or real estate)

- Next-generation digital payment products

C. Seamless Integration

Because QSSN only upgrades the “privileged” functions (like minting and burning), it doesn’t require changes to wallets, user interfaces, or compliance systems. This makes it easy for institutions to adopt without retraining staff or rewriting code.

D. Verifiable Security

Regulators and auditors can see a clear, tamper-proof record of every privileged transaction, signed with quantum-safe cryptography. This builds trust and transparency in the system.

Real-World Example: JPMorgan’s USD Deposit Token

JPMorgan Chase, the world’s largest bank, is piloting a USD deposit token on Coinbase’s Base network. This token lets clients move deposits on-chain, 24/7. With QSSN, JPMorgan can make this token quantum-secure, meeting both current and future regulatory requirements—without changing how clients use the service.

Practical Advice: How Can Banks and Platforms Prepare for Quantum Threats?

Step 1: Assess Your Stablecoin Exposure

- Identify which digital assets and stablecoins your business relies on.

- Map out which operations (minting, burning, admin changes) are most critical.

Step 2: Evaluate Quantum-Safe Solutions

- Look for frameworks like QSSN that offer dual-signature protection and hardware security.

- Ensure the solution is compatible with your existing workflows and compliance needs.

Step 3: Plan for Regulatory Compliance

- Stay updated on government mandates for quantum-safe infrastructure.

- Work with vendors who have experience in quantum-safe standards.

Step 4: Educate Your Team

- Train technical and compliance staff on the basics of quantum risk and how new solutions work.

- Communicate to clients and partners about your commitment to future-proof security.

Step 5: Monitor and Adapt

- Quantum computing is evolving fast. Regularly review your security posture and upgrade as needed.

Simple Chemical Solution Produces Ultra-Thin Materials With Powerful Electronic Properties

Quantum Sensing: NASA Demonstrates Ultracold Quantum Sensor in Space

Quasiparticle Chirality and Electron-Phonon Interactions Drive Novel Material Phases

FAQs About BTQ Launches Quantum-Safe Framework

What is a stablecoin?

A stablecoin is a digital currency designed to keep a steady value, usually by being tied to something stable like the US dollar.

What is quantum computing, and why is it a threat?

Quantum computers are super-powerful machines that can solve problems regular computers can’t. They could break today’s cryptographic codes, making digital money vulnerable to theft or fraud.

How does QSSN protect stablecoins?

QSSN uses dual cryptographic signatures—one standard and one quantum-safe—plus secure hardware to protect the most sensitive stablecoin operations.

Will QSSN change how I use stablecoins?

No. All changes happen behind the scenes. Users, businesses, and institutions don’t need to change how they interact with stablecoins.

Is QSSN available for all types of stablecoins?

Yes. QSSN supports fiat-backed, bank-issued, and real-world asset tokens, making it flexible for different financial needs.