The global race for dominance in artificial intelligence (AI) is heating up, and at the heart of this competition lies the battle over AI chips. The topic, “China’s AI Chip War Strategy May Already Be Outpacing the West’s Response,” is more than just a headline—it’s a reflection of a seismic shift in technology, economics, and geopolitics. As China rapidly scales up its AI chip capabilities, the world is watching closely to see if the West can maintain its lead or if a new superpower in technology is emerging.

China’s AI Chip War Strategy

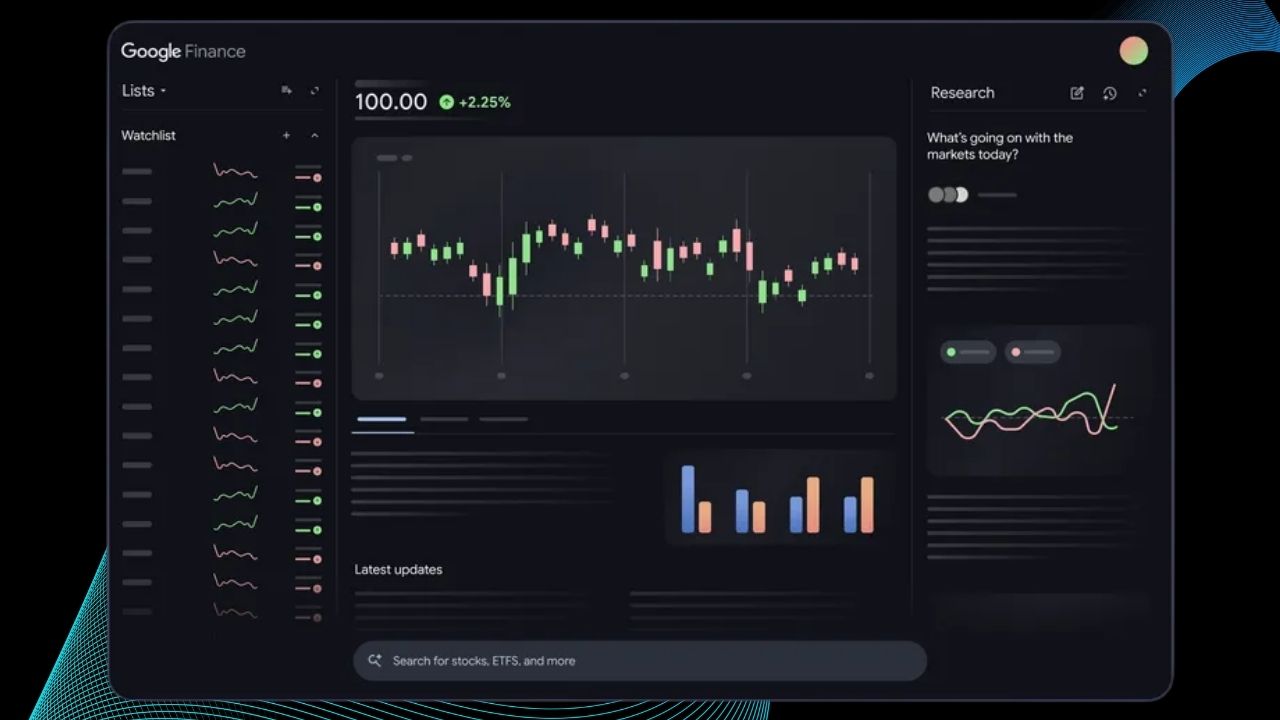

| Aspect | China’s Progress (2025) | West’s Response & Status (2025) |

|---|---|---|

| AI Chip Market Share | Domestic vendors (e.g., Huawei) at ~40% in China, closing gap with imports | Nvidia/AMD still lead globally |

| Government Investment | $47B “Big Fund” for chip R&D; $25B+ in new initiatives | US CHIPS Act: $52.7B for domestic manufacturing |

| Tech Gap | 7nm–14nm chips in mass production; R&D into 5nm | US/EU/TSMC lead with 3nm–5nm |

| Export Controls | Facing strict US/EU restrictions, especially on EUV lithography | Tightened controls, expanded in May 2025 |

| AI Model Training | 2 of 321 notable models trained on Chinese chips | 319/321 models trained on US chips |

| Strategic Focus | Specialized AI models, vertical applications, RISC-V, academic partnerships | General-purpose models, cloud dominance |

China’s AI chip war strategy is advancing rapidly, powered by massive investment, innovation, and a clear focus on self-reliance. While China is closing the gap with the West—especially in its domestic market and specialized applications—the US and its allies still lead in the most advanced chip technology and large-scale AI training. The competition is intensifying, and both sides are adapting quickly. For professionals and businesses, staying informed and agile is crucial as the global tech landscape shifts.

What Are AI Chips and Why Are They So Important?

AI chips are specialized computer processors designed to handle the complex calculations that power artificial intelligence. They’re the “brains” behind self-driving cars, voice assistants, facial recognition, smart factories, and even national defense systems. The faster and smarter these chips are, the more advanced and capable AI systems become.

Why is this a global “war”?

Because whoever leads in AI chip technology can shape the future of industries, economies, and even the balance of power between nations. The ability to design and manufacture cutting-edge AI chips is now seen as a critical national asset.

How China’s AI Chip War Strategy Developed

1. Massive State Investment and Ambitious Policy

China’s government has made AI and semiconductor self-reliance a national priority. In April 2025, President Xi Jinping emphasized the need for “strongly oriented” AI applications and self-sufficiency in the Politburo. The country’s “Big Fund” has invested $47 billion into domestic chip research and manufacturing, with additional billions flowing into new chip factories and R&D projects.

- Example: Huawei, China’s tech giant, is at the forefront with its Ascend series of AI chips. These are now being used by major Chinese firms like ByteDance and Ant Group for certain AI workloads, although the most advanced AI training still relies on US hardware.

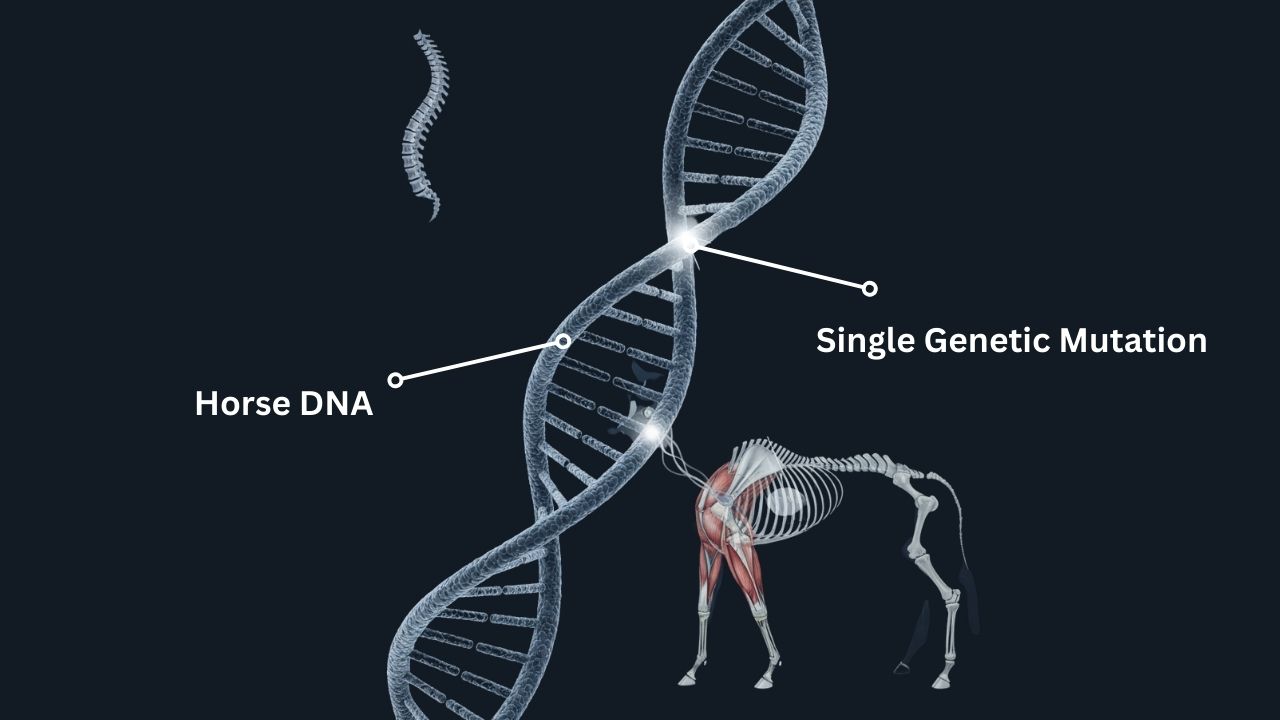

2. Domestic Innovation and Focused Specialization

Chinese companies are not simply copying Western technology—they’re innovating and adapting. Key strategies include:

- Developing application-specific integrated circuits (ASICs) for highly efficient AI tasks.

- Focusing on vertical AI models—specialized systems for business, healthcare, or government that can outperform general-purpose models in specific areas.

- Embracing open-source architectures like RISC-V to sidestep US patent restrictions and encourage collaborative development.

By 2025, Chinese vendors are expected to supply about 40% of AI chips used domestically, nearly matching imported chips from Nvidia and AMD.

3. Academic and Regional Collaboration

Top Chinese universities like Tsinghua and Peking are working with startups and local governments to drive AI chip innovation. This decentralized approach allows different regions to tailor strategies to their strengths, creating a diverse and resilient ecosystem for AI research and development.

4. Strategic Acquisitions and Technology Transfer

China has pursued a mix of legal and sometimes controversial methods to accelerate its progress:

- Acquisitions: Buying stakes in Western tech companies or licensing their intellectual property.

- Talent recruitment: Attracting global experts to Chinese firms and research institutions.

- Technology transfer: Encouraging partnerships and joint ventures to gain access to advanced design and manufacturing techniques.

The West’s Response: Defense, Investment, and Innovation

1. Export Controls and Sanctions

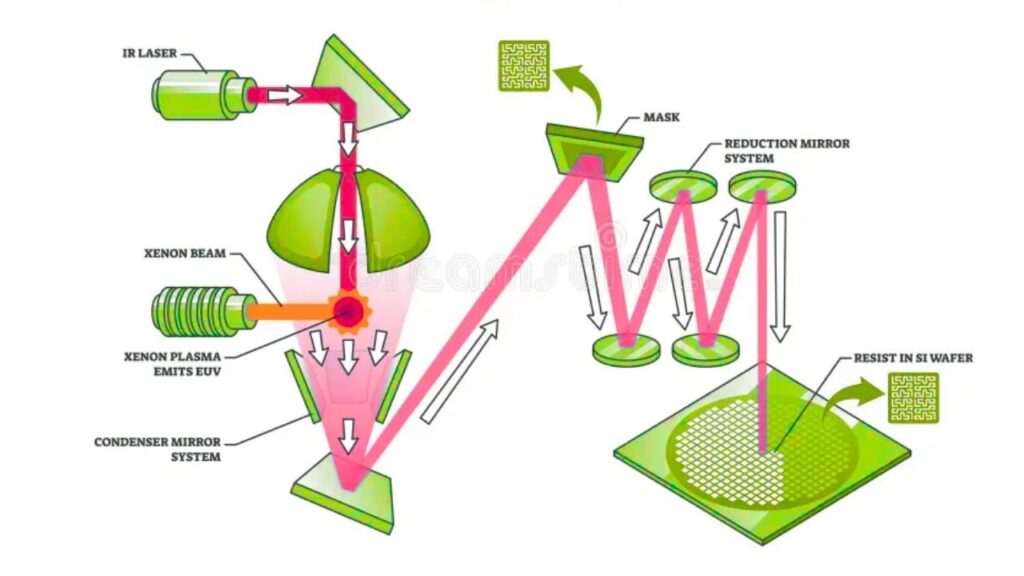

The US and its allies have tightened export controls, especially on the most advanced chipmaking equipment such as extreme ultraviolet (EUV) lithography machines. In May 2025, new rules further restricted China’s access to cutting-edge technology, making it illegal for non-US companies to help China develop advanced chips without a license.

- Impact: TSMC, the world’s leading chipmaker, stopped supplying advanced chips to China in late 2024, slowing China’s access to the latest technology.

2. Massive Domestic Investment

The US passed the CHIPS Act, investing $52.7 billion in domestic semiconductor manufacturing and research. Europe and Japan are also ramping up their own chip production and research efforts to stay competitive.

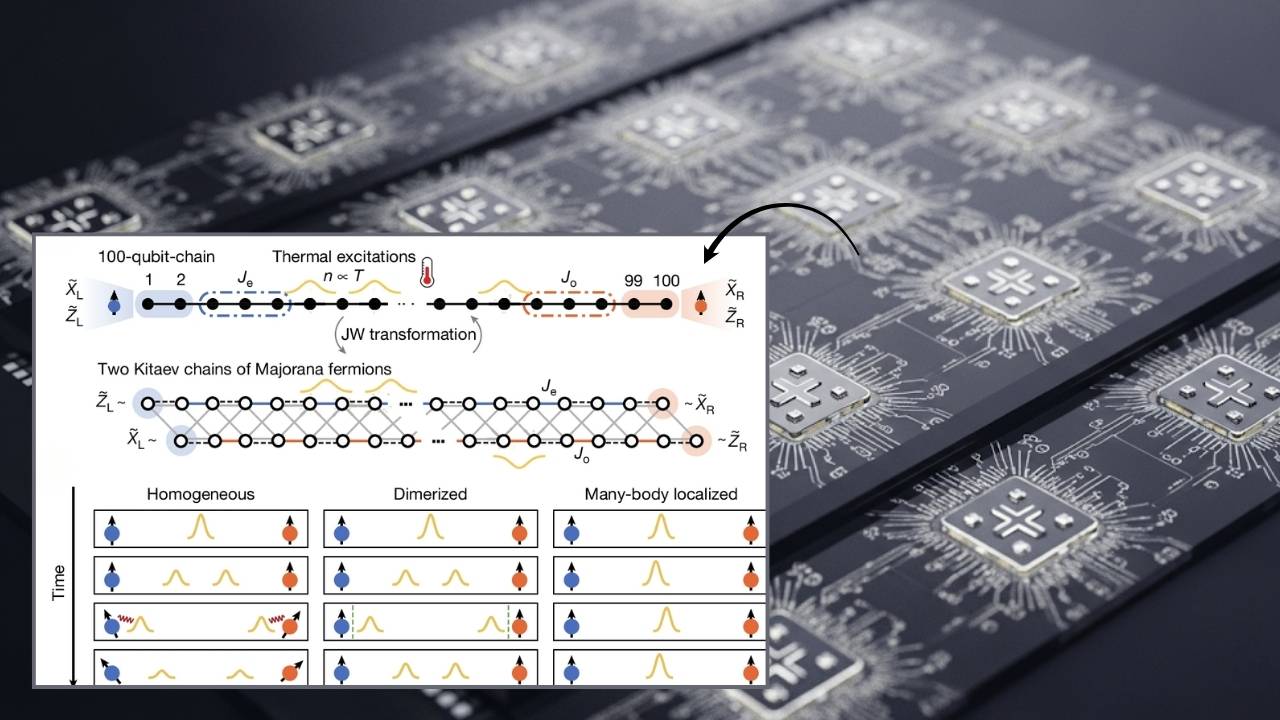

3. Maintaining the Lead in AI Model Training

Despite China’s rapid progress, the US still dominates in large-scale AI model training. Out of 321 notable AI models, 319 have been trained on US chips, and only two on Chinese hardware. American firms like Nvidia, AMD, and Intel remain global leaders in AI chip design and manufacturing.

China’s Progress: Strengths, Challenges, and Global Impact

Strengths

- Scale and Speed: China’s AI industry is now worth over $70 billion, with more than 4,300 companies active in the sector. The government aims to grow the core AI industry to over $140 billion by 2030 and related sectors to $1.4 trillion.

- Workforce: China’s rapidly growing AI workforce and access to massive datasets give it a unique edge, especially for training AI in fields like surveillance, finance, and healthcare.

- Ecosystem: Regional governments provide incentives for AI startups and smart infrastructure, fostering a vibrant, collaborative innovation environment.

Challenges

- Manufacturing Bottlenecks: Despite progress, China remains dependent on foreign equipment for the most advanced chip manufacturing. US-led export controls on EUV lithography machines and other tools are significant hurdles.

- Quality Gap: While China can mass-produce 14nm chips and is pushing into 7nm and 5nm territory, it still lags behind global leaders like TSMC, which is producing 3nm chips.

- Model Training: Chinese AI chips are not yet widely adopted for training large-scale AI models. Most advanced AI models are still trained on US hardware, though Chinese chips are increasingly used for inference (running trained models).

Market Data

- The Chinese semiconductor market size reached $182.8 billion in 2024 and is projected to grow to $429.9 billion by 2033.

- The AI chip market in China is expected to reach $46.53 billion in 2025, with a compound annual growth rate (CAGR) of over 7%.

- Huawei’s chip production capacity for 2025 is estimated at no more than 200,000 advanced AI chips, which is below domestic demand but signals rapid progress.

How China Is Catching Up: A Step-by-Step Guide

Step 1: Identify Strategic Weaknesses

China systematically analyzes the global chip supply chain to find vulnerabilities—such as overreliance on a few suppliers or high R&D costs.

Step 2: Invest Heavily in R&D

The government and private sector pour billions into research on chip design, manufacturing, and advanced packaging technologies. This includes workarounds for restricted equipment and developing domestic alternatives.

Step 3: Build Domestic Manufacturing

Companies like SMIC and Huawei expand production of AI chips, focusing on catching up with global leaders in both volume and technology.

Step 4: Foster Ecosystem Collaboration

Universities, startups, and local governments collaborate to innovate and adapt AI technologies for local markets, creating a robust pipeline of talent and ideas.

Step 5: Adapt to Export Controls

China develops alternative technologies and open-source solutions (such as RISC-V) to bypass Western restrictions and foster homegrown innovation.

Step 6: Scale Up and Commercialize

Chinese firms rapidly scale up production and push AI chips into consumer electronics, security, and industrial applications, accelerating domestic adoption.

Practical Advice for Professionals and Businesses

- Diversify Supply Chains: Don’t rely solely on one country or company for critical chip supplies. Explore partnerships and alternative vendors.

- Invest in Talent: AI and semiconductor talent are in high demand. Invest in training and retaining skilled engineers and researchers.

- Stay Informed: Monitor policy changes, as export controls and sanctions can shift quickly and impact global operations.

- Collaborate Wisely: Strategic partnerships and joint ventures can help share R&D costs and access new technologies, but be mindful of intellectual property risks.

Meta Launches New AGI Lab to Dominate the Future of Artificial Intelligence

Ooredoo and NVIDIA Unite to Build Qatar’s Supercharged AI Future

FAQs About China’s AI Chip War Strategy

Q1: Are Chinese AI chips as good as American ones?

Not yet for the most advanced uses. Chinese chips are improving quickly and work well for many applications, but the US still leads in the most powerful chips for large AI models.

Q2: Why are AI chips so important?

AI chips are the “brains” behind smart technologies. They make AI faster, cheaper, and more powerful, affecting everything from smartphones to national defense.

Q3: Will China overtake the US in AI chips?

China is closing the gap, especially in specialized areas, but the US and its allies still hold the lead in cutting-edge technology and global market share.

Q4: How do export controls affect the chip war?

Export controls slow China’s access to the latest technology, but also push China to innovate and seek alternatives.

Q5: What should businesses do to prepare?

Diversify suppliers, invest in AI talent, and stay updated on policy changes to manage risks and seize new opportunities.