CRA November 2025 Payments: As November 2025 kicks in, thousands of Canadians are keeping a close eye on their Canada Revenue Agency (CRA) payments. These payments are more than just numbers hitting bank accounts—they’re vital support to families, seniors, workers, and vulnerable populations struggling with day-to-day expenses. Understanding which benefits you qualify for, the amount you can expect, and exactly when these payments come through is crucial for managing your financial life with peace of mind.

Whether you’re a parent raising kids, a senior living on a fixed income, or someone relying on a boost to get by, the CRA’s November payment schedule has something important for you. This article breaks down every major benefit, payment amounts, dates, and tips on how to get the most out of what’s available. The goal here? To make the info super clear and usable—even a 10-year-old could follow it—while providing seasoned insights for anyone navigating financial planning or professional advisory roles.

Table of Contents

CRA November 2025 Payments

The CRA payments in November 2025 are more than just government checks—they’re crucial support helping millions manage everyday expenses amidst inflation and economic uncertainty. Whether you’re chasing that Canada Child Benefit, counting on OAS for retirement, or awaiting the one-time $2400 boost, understanding the dates, amounts, and eligibility requirements is key. Stay proactive: file taxes on time, keep your information updated, and sign up for direct deposit to get the full benefit. This knowledge empowers you to navigate Canada’s social support system efficiently, putting you on a steadier financial footing today and tomorrow.

| Benefit | Payment Date (November 2025) | Typical Amount | Who’s Eligible? |

|---|---|---|---|

| Canada Child Benefit (CCB) | November 20, 2025 | ~$620 per child/month | Low/moderate income families with children |

| Old Age Security (OAS) | November 27, 2025 | Up to $713 monthly | Seniors 65+ with Canadian residency |

| Canada Pension Plan (CPP) | November 27, 2025 | Average $1,307 monthly | Retirees and disabled contributors |

| GST/HST Credit | Next payment Jan 3, 2026 | ~$496 quarterly | Low/moderate income individuals |

| Canada Workers Benefit (CWB) | November 15, 2025 | Varies (around $350 advance) | Working low-income individuals |

| $2400 One-Time Federal Payment | Late November 2025* | One-time up to $2400 | Seniors, CPP-D, GIS recipients, low-income Canadians |

| Climate Action Incentive Payment | November 15, 2025 | ~ $188 per adult quarterly | Residents in provinces with carbon pricing |

What Are CRA November 2025 Payments? The Basics

The Canada Revenue Agency (CRA) plays a huge role in supporting Canadians through a suite of benefit programs designed to ease financial burdens. These benefits focus mainly on families raising kids, seniors needing steady income, working people with modest wages, and vulnerable groups such as those with disabilities.

Think of it like a safety net that catches millions every month—putting cash in pockets for essentials like food, rent, and healthcare.

Here’s a quick list of the biggest benefits you’ll hear about this November:

- Canada Child Benefit (CCB): Helps cover costs for kids under 18.

- Old Age Security (OAS): Monthly support for seniors aged 65 and older.

- Canada Pension Plan (CPP): Retirement or disability income based on your contributions.

- GST/HST Credit: Quarterly credit to offset sales taxes for lower-income families.

- Canada Workers Benefit (CWB): Financial boost for working Canadians earning low income.

- One-Time Federal Payments: Extra money to help with inflation or other special needs.

- Climate Action Incentive: Rebates for residents in provinces with carbon pricing.

A Bit of History: Why CRA Benefits Matter

The CRA is relatively young in its current form—officially coming into being as a separate agency in 1999—but its roots trace back to older government programs. The Canadian government has been supporting families and seniors through tax benefits since the 1940s, with the first family allowance appearing in 1945.

These programs evolved as Canada’s society and economy changed, particularly during the 1970s and 80s, when benefits became more income-based and refundable tax credits grew popular. The CRA’s modern benefit system represents decades of refining how best to distribute government support efficiently and fairly.

Importantly, while these programs are designed to support all Canadians, Indigenous communities historically faced unique challenges with benefit access, some of which continue to be addressed today.

Why November 2025 Benefits Are Especially Important

With inflation still impacting food prices, housing costs, and utility bills, these CRA benefits are more critical than ever. The Canadian government recognizes this, which explains the inclusion of one-time federal payments (up to $2400) for seniors, CPP Disability recipients, and other vulnerable groups—the boost is intended to offset rising expenses.

For families, the Canada Child Benefit remains a lifeline. It adjusts based on income to target support where it’s most needed.

For retirees, OAS and CPP payments help secure monthly income so seniors can comfortably cover basic needs.

Breakdown of CRA November 2025 Payments

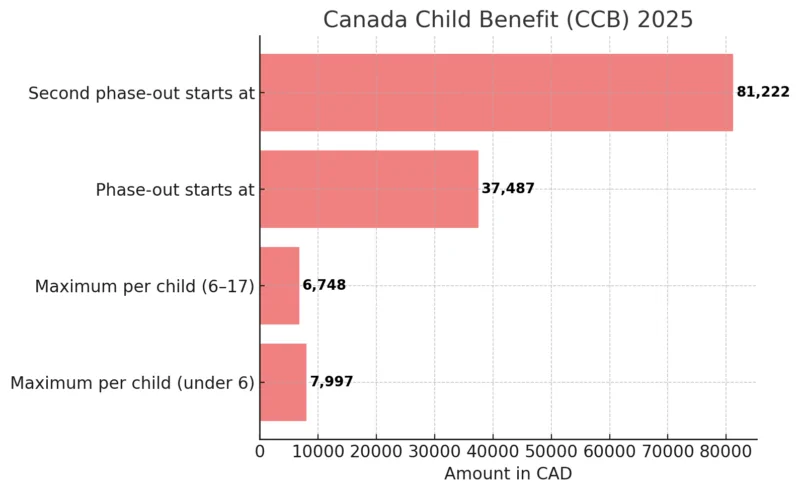

Canada Child Benefit (CCB)

Scheduled for November 20, this monthly benefit averages $620 per child, varying by family income and number of kids. It’s tax-free cash aimed at supporting essential child-related expenses—think groceries, clothes, and school supplies. To keep this benefit flowing smoothly, you’ve got to file your taxes every year and update your family status with CRA.

Old Age Security (OAS)

Paid on November 27, OAS offers up to $713 per month to qualifying seniors. If you’re 65 or older and meet residency rules, this payment ensures you have a steady income stream. FYI, income affects whether you pay a clawback tax on OAS, so keep an eye on annual earnings.

Canada Pension Plan (CPP)

Also on November 27, CPP benefits average about $1,307 per month. This is your retirement or disability income based on contributions made during your working years. The more you contributed, the bigger your payments—delaying CPP can even increase your monthly amount.

GST/HST Credit

Although the next payment isn’t until January 3, 2026, this quarterly credit usually runs about $496 for eligible households. It helps low-to-moderate income families offset sales taxes paid throughout the year. File your taxes on time to keep eligibility intact.

Canada Workers Benefit (CWB)

An advance payment lands on November 15, averaging around $350. This program is a helping hand for workers earning low wages. It’s automatically calculated based on last year’s income, so timely tax filing is important.

$2400 One-Time Federal Payment

Expected in late November, this hefty payment goes out to seniors, CPP Disability recipients, Guaranteed Income Supplement recipients, and low-income Canadians to help with inflation impacts. No action needed if you’re eligible—just keep your CRA profile updated.

Climate Action Incentive Payment

On November 15, residents in provinces with carbon pricing (like Ontario and Alberta) get around $188 per adult quarterly. This environmental rebate offsets carbon tax costs and helps families manage their budgets.

Practical Tips to Maximize Your Benefits

- File Your Taxes on Time: This is the golden rule—miss filing, and you risk delayed or missed payments.

- Set Up Direct Deposit: Avoid mailing delays and get your money faster into your account.

- Keep Your Info Current: Update your address, marital status, and banking info with CRA regularly.

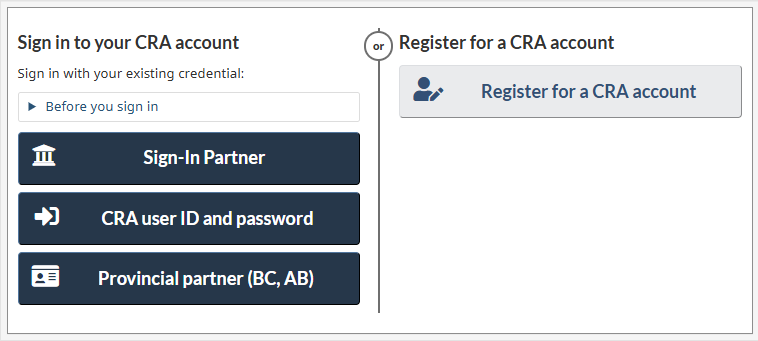

- Check Online: Use the CRA My Account portal to track your payments and benefits.

- Combine Benefits: Don’t overlook provincial and territorial benefits that can stack up with CRA programs.

- Plan for Income Clawbacks: Seniors especially should keep track of income limits to avoid OAS clawbacks.

Common Pitfalls to Avoid

- Ignoring CRA notices or failing to respond to verification requests.

- Assuming benefits are automatic without fulfilling conditions like tax filing.

- Using outdated banking or personal info causing payment delays.

- Not understanding which payments are taxable and preparing accordingly.

Real-World Examples

Consider Maria, a single mom with two kids. She receives CCB monthly, which helps cover daycare and groceries, freeing up some cash for emergencies. Because she files taxes promptly online, her payments hit her account regularly without a hitch.

Or John, a 68-year-old retiree who relies on OAS and CPP for steady income. When the $2400 one-time federal payment arrives, he uses it to cover rising heating bills this winter.

How CRA Compares with US Social Benefits?

Unlike the US where Social Security and other welfare programs operate under different agencies and state rules, CRA centralizes many benefits under one roof, simplifying access for Canadians. The direct deposit system is robust, and several refundable tax credits provide upfront cash rather than just tax deductions.

Canada Advances Quantum Error Correction Techniques for Scalable Quantum Computing

Canadian Scientists Just Cracked a Major Quantum Problem — Say Hello to Smarter Qubits