As 2025 progresses, the threat of stimulus check scams has escalated, with fraudsters utilizing AI-driven voice technology, fake text messages, and fraudulent checks to deceive unsuspecting individuals.

These scams not only target consumers directly but also exploit the public’s expectation of government relief. Experts warn that these threats could cost victims millions unless people are vigilant in recognizing and reporting suspicious activity.

Table of Contents

Most Dangerous Stimulus Check Scams

| Key Fact | Detail/Statistic |

|---|---|

| AI Voice Manipulation Scams | Scammers are using AI to mimic trusted voices, tricking victims into handing over personal information |

| Fake Text Messages and Phishing Links | Fraudulent text messages with links leading to fake websites that steal personal data |

| Counterfeit Stimulus Checks | Fake checks that appear legitimate, leading to losses when they bounce |

| Government Alerts and Protection Tips | The IRS will never initiate contact via text or email; government checks are typically issued through mail |

The Growing Threat of Stimulus Check Scams in 2025

AI Voices and Deepfakes: The Next Frontier in Fraud

As technology advances, so too do the methods used by scammers. One of the most concerning threats emerging in 2025 involves the use of artificial intelligence (AI) to create lifelike voice simulations. Known as “deepfake” voice scams, this technology allows fraudsters to mimic the voices of trusted individuals, such as family members or financial advisors.

The scam typically begins with a phone call from what appears to be a loved one or a reputable figure. Using AI-generated voices, scammers convince victims that they need to transfer funds or provide sensitive information. These deepfakes are becoming increasingly difficult to detect, and the emotional manipulation used in these scams makes them highly effective, especially against older adults.

In some cases, scammers have used AI-generated voices to impersonate government officials or representatives from the IRS, further blurring the line between legitimate and fraudulent communications. According to the Federal Trade Commission (FTC), such scams are on the rise, and experts warn that they could become a standard tactic for criminals in the coming years.

Phishing Scams: Fake Texts and Links to Fake Websites

Another major form of stimulus check fraud in 2025 involves phishing scams via text messages. These scams work by sending fraudulent texts that claim the recipient is eligible for a stimulus check or tax refund. The message typically includes a link to a website designed to appear official, often mimicking the appearance of government portals like IRS.gov.

However, these sites are nothing more than tools for harvesting sensitive information such as Social Security numbers, bank account details, and credit card information. Once the user inputs their data, it is immediately sent to the scammers, who can then use it for identity theft or financial fraud.

The Better Business Bureau (BBB) has issued multiple warnings regarding these scams, stressing that the IRS does not initiate contact with taxpayers via text message. As with many phishing attempts, the best defense is skepticism—do not click on links in unsolicited messages, even if they appear to come from a trusted source.

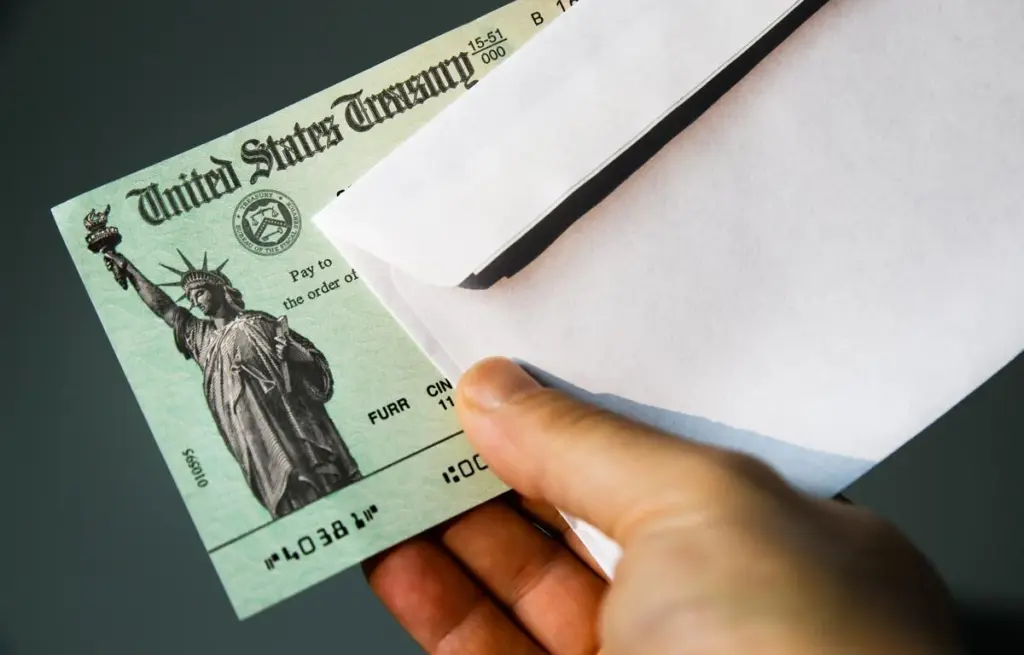

Counterfeit Stimulus Checks: Fraudulent Paper Documents

While digital scams have become more prevalent, counterfeit checks remain a tried-and-true method for scammers. In 2025, fraudsters are sending fake checks that look almost identical to legitimate government-issued stimulus checks. These checks often have official-looking logos and security features, making it difficult for recipients to distinguish them from genuine payments.

Once the victim deposits the check into their account, they may receive a follow-up message demanding that they return the funds due to a supposed error in the payment. The catch is that the original check will eventually bounce, leaving the victim liable for the full amount, while the scammers are long gone.

The FTC has warned that such schemes are particularly damaging because they exploit people’s eagerness to receive financial relief. If the victim returns the money as requested, they are effectively handing over real funds to the fraudsters, unaware that the check was fake.

Protect Yourself from Stimulus Check Scams

- Verify Communication: If you receive a phone call, text, or email claiming to be from the IRS or another government agency, verify it through official channels. The IRS never sends unsolicited messages via text, and any legitimate communication will be sent through mail.

- Be Cautious with Links: Do not click on links in unsolicited text messages or emails. Always type the URL directly into your browser to access official websites.

- Check the Check: Inspect any checks you receive carefully. Look for signs of counterfeiting, such as blurry logos or unusual printing. If in doubt, contact your bank for verification.

- Use Two-Factor Authentication: For any online accounts related to finances, set up two-factor authentication to add an extra layer of protection against unauthorized access.

- Report Suspicious Activity: If you suspect a scam, report it immediately to the IRS at [email protected] or to the FTC through their report fraud website.

Understanding the Scale of Stimulus Check Scams in 2025

Stimulus check scams have evolved with the changing landscape of government financial aid. As artificial intelligence and machine learning tools become more accessible to criminals, the potential for new, highly sophisticated scams increases.

The FTC reports that in 2025, there has been a significant uptick in reports of AI voice scams, phishing text messages, and fraudulent check operations targeting individuals across the U.S.

The rise in scams coincides with ongoing government efforts to distribute financial relief, including stimulus checks, to support individuals affected by economic downturns. These measures are particularly vulnerable to exploitation by criminals who are skilled in digital manipulation and psychological tactics.

The IRS and the BBB have urged the public to be on high alert, noting that scams are likely to proliferate as more stimulus checks are distributed. As more people rely on government relief, they are increasingly targeted by fraudsters who use high-tech methods to deceive them.

Related Links

Get Up to $1,751 Texas SNAP Benefits This Month : How to Get Yours?

Data Breach Settlement 2025: You Might Be Eligible for a $5,000 Payout – Here’s How to Claim

Concluding Thoughts: Staying One Step Ahead of Scammers

As 2025 continues to unfold, stimulus check scams show no signs of slowing down. Scammers are becoming increasingly creative, leveraging advanced technologies like AI and deepfake voices to trick individuals into providing personal information or transferring funds. With government relief efforts in the spotlight, fraudsters will continue to exploit public expectations and vulnerabilities.

The key to avoiding these scams lies in vigilance and education. By understanding the methods used by criminals and recognizing the warning signs, individuals can better protect themselves and their finances. As always, remember that legitimate government agencies will never ask for sensitive information via text or email—be skeptical, verify all communications, and report any suspicious activity.

FAQ

Q1: How do I know if a stimulus check I received is real?

A1: Look for official signs of authenticity, such as a U.S. Treasury seal, correct formatting, and matching IRS records. If you’re unsure, contact your bank or the IRS directly.

Q2: What should I do if I receive a suspicious text claiming to be from the IRS?

A2: Do not click on any links in the message. Report the text to the IRS and delete it. Always verify IRS communications through their official website or contact number.

Q3: Can scammers use AI to mimic my family members’ voices?

A3: Yes. AI-powered voice technology allows scammers to impersonate familiar voices, making it harder to detect fraud. Always verify through other means before taking any action based on phone calls or voice messages.