Nvidia-backed CoreWeave has just made a bold $9 billion all-stock acquisition of Core Scientific, a move that is sending ripples across the global technology and cloud infrastructure landscape. This strategic deal is not just about financial figures—it signals a significant shift in how the world’s most powerful computing resources are being managed, deployed, and accessed, especially as artificial intelligence (AI) continues to transform industries.

In this article, we’ll unpack what this acquisition means, why it matters, and how it’s likely to impact businesses, investors, and professionals in the fast-evolving world of cloud computing and AI. The explanations are clear and approachable, with practical insights and real-world examples to help everyone—from curious students to seasoned IT professionals—understand the big picture.

Nvidia-Backed CoreWeave Just Made a $9 Billion Move

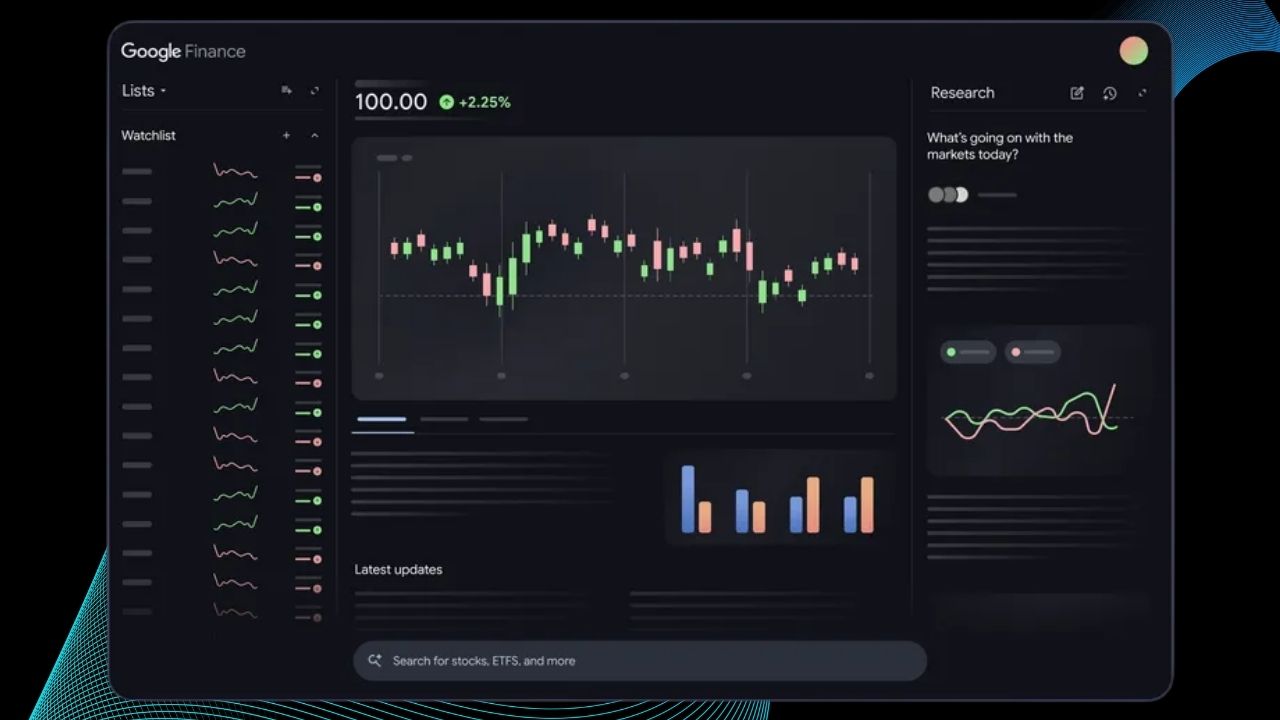

| Key Point | Details |

|---|---|

| Deal Value | ~$9 billion (all-stock transaction) |

| Companies Involved | CoreWeave (AI cloud infrastructure) acquires Core Scientific (data center & crypto mining) |

| Shareholder Terms | 0.1235 CoreWeave shares for each Core Scientific share (valued at ~$20.40/share, 66% premium) |

| Data Center Capacity | 1.3 GW of gross power acquired, with 1 GW+ available for expansion |

| Cost Savings | Eliminates ~$10 billion in future lease obligations; $500 million in annual cost savings projected by 2027 |

| Deal Timeline | Expected to close in Q4 2025 (pending regulatory and shareholder approval) |

| Strategic Impact | Vertical integration, enhanced efficiency, direct control over critical infrastructure |

| Official Website | CoreWeave |

CoreWeave’s $9 billion acquisition of Core Scientific is a watershed moment in the cloud and AI infrastructure industry. By bringing critical data center assets in-house, CoreWeave is poised to accelerate innovation, improve efficiency, and compete directly with the world’s largest cloud providers. For businesses, professionals, and investors, this deal signals new opportunities and a reshaping of the technology landscape as AI continues to drive the next wave of digital transformation.

What Is CoreWeave and Why Does It Matter?

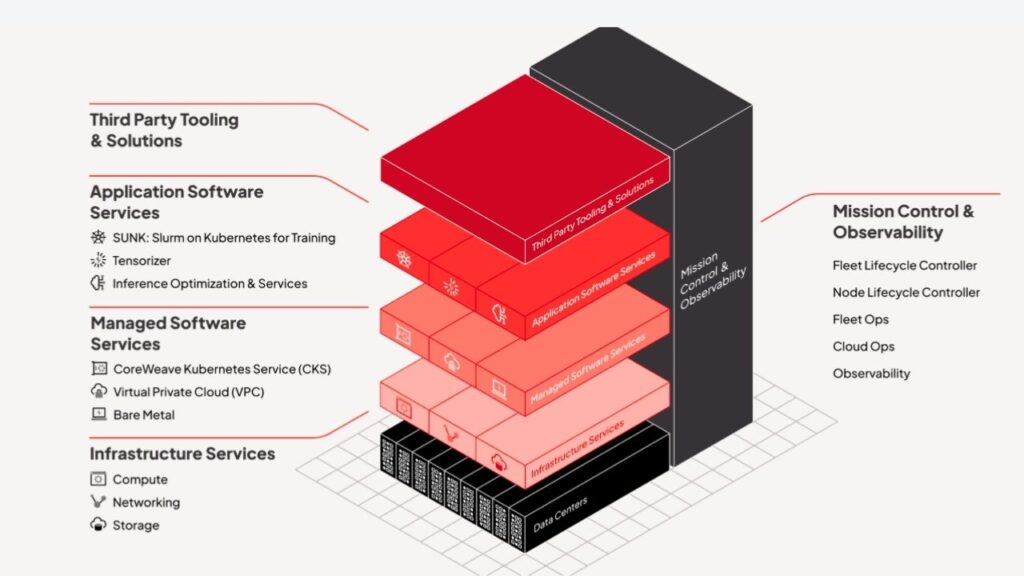

CoreWeave is a rapidly growing cloud infrastructure company that specializes in high-performance computing (HPC) and artificial intelligence (AI) workloads. Unlike traditional cloud service providers that offer a broad range of general computing services, CoreWeave focuses on providing powerful, GPU-rich environments. This makes it a go-to choice for companies and research institutions that need to train large AI models, run complex simulations, or deliver next-generation digital experiences.

What sets CoreWeave apart is its close relationship with Nvidia, the world’s leading supplier of graphics processing units (GPUs). Nvidia’s backing has given CoreWeave priority access to the latest and most powerful AI hardware, helping it stand out in a crowded and competitive market.

Breaking Down the $9 Billion Acquisition

What Did CoreWeave Acquire?

CoreWeave is acquiring Core Scientific, a company that owns and operates some of the largest data centers in the United States. While Core Scientific was originally known for its role in cryptocurrency mining, it has recently shifted focus toward providing the kind of high-powered, energy-efficient infrastructure that AI and cloud computing demand.

The acquisition gives CoreWeave direct ownership of data centers with a total power capacity of about 1.3 gigawatts (GW). To put this in perspective, that’s enough energy to power more than a million high-performance computers at once. There’s also significant room for expansion, with over 1 GW of additional capacity possible at Core Scientific’s sites.

Why Is This Move So Significant?

- Eliminating Lease Costs: Before this deal, CoreWeave was renting much of its data center space from Core Scientific. By acquiring the company, CoreWeave will eliminate around $10 billion in future lease obligations, freeing up enormous financial resources for reinvestment in technology and growth.

- Boosting Efficiency: Owning its infrastructure allows CoreWeave to streamline operations, reduce overhead, and control costs more effectively.

- Expanding Capacity: The deal instantly increases CoreWeave’s ability to serve more customers and handle larger, more complex workloads.

- Strengthening AI Leadership: With Nvidia’s support and direct control over critical infrastructure, CoreWeave is positioned to deliver top-tier performance for AI and HPC workloads, challenging even the largest cloud providers.

How Does the Deal Work?

- All-Stock Transaction: Core Scientific shareholders will receive 0.1235 shares of CoreWeave for each share they own, valuing their holdings at about $20.40 per share—a 66% premium over the pre-announcement price.

- Shareholder Impact: After the merger, Core Scientific shareholders will own less than 10% of the combined company.

- Deal Timeline: The acquisition is expected to close in the fourth quarter of 2025, pending regulatory and shareholder approvals.

The Strategic Power of Vertical Integration

Vertical integration means that CoreWeave will now own and control more of its supply chain. Instead of relying on third-party landlords for data center space, it will own the buildings, the power infrastructure, and the operations.

Why Is Vertical Integration a Game-Changer?

- Cost Control: By owning its infrastructure, CoreWeave can avoid rent payments and redirect savings toward innovation and expansion.

- Operational Flexibility: The company can quickly adapt to changing customer needs and market demands without being limited by lease agreements.

- Risk Reduction: Direct ownership reduces the risk of lease disputes, sudden rent increases, or operational restrictions.

- Faster Innovation: With full control over its infrastructure, CoreWeave can deploy new hardware and services more rapidly, giving it a competitive edge.

The Cloud Data Wars: Why This Deal Matters Now

The demand for AI-powered services has exploded in recent years. Training and running advanced AI models requires vast amounts of computing power, energy, and specialized hardware. This has led to what many experts call the “cloud data wars”—a race among the world’s biggest tech companies to secure the infrastructure needed to power the future.

Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have long dominated the cloud market. However, the rise of AI is changing what customers need from their cloud providers. Companies are looking for partners who can deliver not just storage and basic computing, but massive, reliable, and efficient GPU-powered environments.

CoreWeave’s Competitive Edge

- Direct Access to Nvidia GPUs: Thanks to its relationship with Nvidia, CoreWeave can offer the latest and most powerful AI hardware to its customers.

- Rapid Expansion: The acquisition of Core Scientific’s data centers allows CoreWeave to scale up quickly, meeting the surging demand for AI infrastructure.

- Tailored Services: By focusing on AI and HPC, CoreWeave can provide more specialized, high-performance services than general-purpose cloud providers.

Real-World Impact: What This Means for Businesses and Professionals

For Businesses

- More Choices: Companies seeking AI and HPC cloud services now have a strong alternative to traditional cloud giants.

- Potential Cost Savings: Increased competition could drive down prices or lead to better service offerings.

- Faster Access to AI Power: With more capacity, CoreWeave can onboard new customers quickly—critical for startups and innovators who need to move fast.

For Investors

- Growth Potential: The deal positions CoreWeave for rapid growth in the booming AI infrastructure market.

- Reduced Risk: Eliminating billions in lease obligations and gaining operational control makes the business more resilient and financially stable.

For IT and Data Professionals

- Career Opportunities: As CoreWeave expands, there will be increased demand for data center managers, AI specialists, and cloud engineers.

- New Technologies: Access to the latest Nvidia GPUs and cutting-edge infrastructure offers a unique environment for learning and innovation.

Step-by-Step Guide: What Happens Next?

1. Regulatory and Shareholder Approval

Both companies must secure approval from regulators and shareholders. This ensures the acquisition is fair and does not harm competition in the market.

2. Integration Planning

CoreWeave and Core Scientific will collaborate to merge their operations, staff, and technology. This may involve repurposing or divesting Core Scientific’s remaining crypto mining business to focus solely on AI and cloud services.

3. Infrastructure Expansion

With new data centers under its control, CoreWeave will invest in upgrades, add more GPUs, and prepare for future growth. This step is vital to meeting the increasing demand for high-performance computing resources.

4. Customer Communication

Both companies will keep their customers informed about any changes to services, pricing, or support to ensure a smooth transition.

5. Market Impact

As the deal closes, expect to see new announcements about expanded services, innovative partnerships, and further investments in AI infrastructure from CoreWeave.

Ooredoo and NVIDIA Unite to Build Qatar’s Supercharged AI Future

NVIDIA Powers Europe’s Fastest Supercomputer With Game-Changing Grace Hopper Platform

FAQs About Nvidia-Backed CoreWeave Just Made a $9 Billion Move

What is CoreWeave?

CoreWeave is a cloud infrastructure company focused on providing high-performance computing and AI services. It offers powerful, GPU-based cloud solutions for businesses, researchers, and developers.

Why did CoreWeave buy Core Scientific?

CoreWeave acquired Core Scientific to gain direct control over critical data center infrastructure, eliminate costly leases, and expand its capacity to serve the rapidly growing AI market.

How will this affect Core Scientific’s crypto mining business?

CoreWeave is expected to repurpose or sell off the crypto mining operations, focusing its resources on AI and cloud services.

What does this mean for Core Scientific shareholders?

Shareholders will receive shares in CoreWeave and will own less than 10% of the combined company after the merger.

When will the deal be completed?

The acquisition is expected to close in the fourth quarter of 2025, pending necessary regulatory and shareholder approvals.

Will this affect current CoreWeave or Core Scientific customers?

Both companies are committed to ensuring a smooth transition, with minimal disruption to existing services and customer support.

The Broader Industry Context: What’s at Stake?

The AI revolution is transforming every sector, from healthcare and finance to manufacturing and entertainment. As businesses race to adopt AI, the need for reliable, scalable, and efficient computing infrastructure has never been greater.

CoreWeave’s acquisition of Core Scientific is a direct response to this shift. By securing more data center capacity and power, CoreWeave is positioning itself as a leading provider for the next generation of AI-driven innovation. This move not only strengthens its competitive position but also sets a new standard for what’s possible in the cloud infrastructure industry.

The Future of AI Infrastructure

- Energy Efficiency: Data centers must be designed to handle enormous power loads while minimizing environmental impact. CoreWeave’s expanded capacity brings new opportunities for sustainable growth.

- Security and Reliability: As AI becomes integral to critical business processes, companies will demand the highest levels of security and uptime from their cloud partners.

- Global Reach: The ability to scale quickly and serve customers worldwide will be a key differentiator in the years ahead.