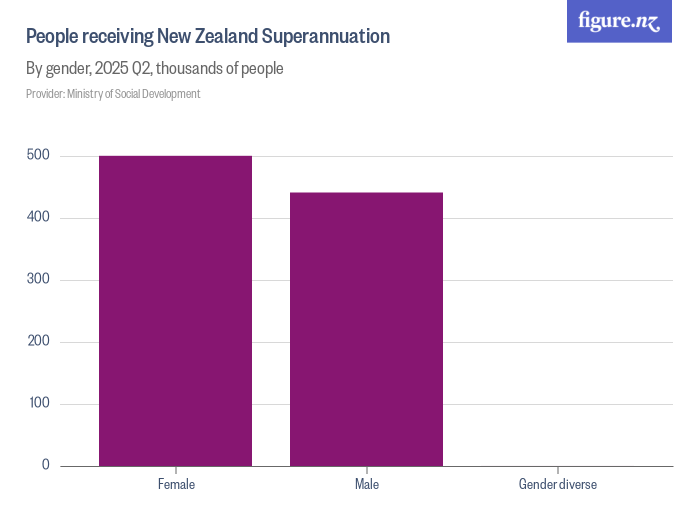

NZ Pension Changes: If you’re gearing up for retirement or already soaking up your golden years in Aotearoa, it’s crucial to stay ahead with the NZ Pension changes in November 2025. From new payment rates to who qualifies, and key dates when you get paid, this guide breaks it all down in a chatty, easy-to-get way—even a 10-year-old could follow along. But don’t let that fool ya—there’s plenty here to keep financial pros nodding too! Let’s dive into the heart of NZ Superannuation (NZ Super), the country’s go-to public pension, and explore what the November 2025 updates mean for kiwis young and old. You’ll get the scoop on who’s eligible, how much money you’re lookin’ at, and how to make the most of it with some expert tips and trusted data.

Table of Contents

NZ Pension Changes

The NZ Pension changes in November 2025 reinforce New Zealand’s commitment to financially supporting its older citizens with steady, reliable, and accessible pension payments. Appreciating the history, eligibility details, application process, and payment rates helps kiwis plan confidently. By supplementing NZ Super with personal savings and smart financial planning, you can turn your retirement years into truly golden ones.

| Feature | Details |

|---|---|

| Payment Dates (November 2025) | November 4 and November 18 (fortnightly payments every Tuesday) |

| Eligible Age | 65 years and older |

| Residency Requirements | At least 10 years living in NZ since age 20, including 5 years after age 50 |

| Payment Rates (Fortnightly) | Single living alone: NZ$1,038.94 Single sharing: NZ$959.02 Couple (both qualify): NZ$1,656.68 |

| Tax Status | Payments are taxable income |

| Application | Online or in-person via Work and Income NZ |

| Official Website | Work and Income NZ Superannuation |

What Is NZ Superannuation? A Detailed Backstory

NZ Super is kinda like a financial backbone for older New Zealanders. It started way back in 1898—making New Zealand the first country in the British Empire, and one of the very first worldwide—to provide a state old-age pension. This was a massive deal because it set a social safety net precedent for the world. The original pension was somewhat strict and means-tested, requiring applicants to prove “good moral character” and meet residency requirements, showing that society wanted to support only the deserving elderly.

By 1938, the government introduced universal superannuation, shifting towards a more inclusive model that didn’t discriminate based on income or assets alone. Fast forward to 1977, when the current NZ Super scheme was formally introduced to provide a universal pension based primarily on age and residency, without income or asset tests for most people. This means if you’ve lived in New Zealand long enough and are 65 or older, you can pretty much count on getting NZ Super.

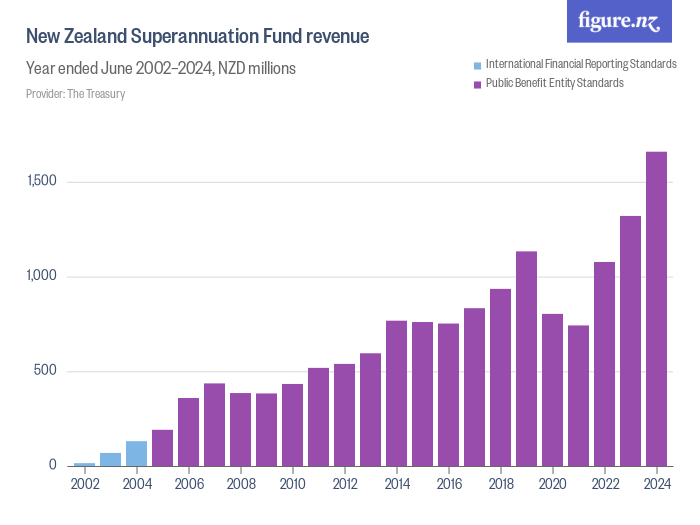

Another milestone came in 2001 with the establishment of the New Zealand Superannuation Fund, also known as the “Cullen Fund” after the then Minister of Finance, Sir Michael Cullen. This sovereign wealth fund was designed to invest government money to help cover the future costs of NZ Super as the population ages. The Fund started investing in 2003 and has since grown significantly, managing billions in assets and following responsible, sustainable investment principles. Its goal is to ease the fiscal burden of a growing retired population and ensure the pension system’s long-term viability.

Payment Dates & Frequency Explained

NZ Super is paid fortnightly, typically on Tuesdays. In November 2025, these payment dates fall on the 4th and 18th. If a scheduled payment date coincides with a public holiday, the payment is usually made one or two days earlier so recipients don’t face delays.

Getting familiar with the payment calendar is key to managing your finances. It helps ensure bills, rent, and groceries get paid on time, avoiding unnecessary stress.

Who Qualifies for NZ Pension Changes?

Here’s what you need to qualify:

- Reach the age of 65 or older.

- Have lived in New Zealand for at least 10 years since you turned 20, with at least 5 of those years after age 50.

- Be either a New Zealand citizen or a permanent resident.

This residency stipulation makes sure the pension supports people who’ve contributed to New Zealand’s economy and society over time.

It’s important to note that the residency rule has evolved through New Zealand’s pension history, reducing from as long as 25 years to the current 10 years to reflect modern mobility and changing population demographics.

How Much Is the Pension? Understanding the 2025 Rates

From April 2025, pension payments increased to keep up with inflation and wage growth. Starting November 2025, here’s the breakdown of your fortnightly NZ Super payments:

- Single person living alone: NZ$1,038.94

- Single person sharing accommodation: NZ$959.02

- Couple (both qualify): NZ$1,656.68 combined

Singles living alone qualify for a higher rate because managing a household solo costs more than sharing. The payment amounts are treated as taxable income, so it’s smart to understand your tax obligations to budget accordingly.

What’s NZ Pension Changes For November 2025?

November itself doesn’t bring new rate changes—those usually happen every April. But a key recent shift is the conclusion of the Winter Energy Payment as of October 1, 2025. This supplement helped pensioners cover heating bills, so its end means budgeting adjustments might be necessary.

Other financial supports like the Accommodation Supplement or Disability Allowance continue, helping low or fixed-income seniors manage housing, health, and living costs.

Real-Life Example: How NZ Super Makes a Difference

Let’s say Joan, a 67-year-old widow in Auckland, relies largely on NZ Super. Before 2025’s rate bump, her payments were slightly less. That increment now eases her grocery bills and takes some pressure off rising utility costs. She qualifies for the Accommodation Supplement too, which helps with rent.

Joan’s story reflects many Kiwi retirees who depend on NZ Super as their retirement bedrock, supplementing it with personal savings or part-time work when possible.

How to Apply for NZ Pension Changes: Step-By-Step

Getting your pension setup is simpler than you might think:

- Prepare documents – proof of age, residency, and identity.

- Apply online at the official Work and Income page.

- You can also apply in-person at local Work and Income offices if you prefer one-on-one help.

- Apply early—up to three months before your 65th birthday to avoid delays.

- Once approved, set up a direct deposit to get payments straight to your bank.

This streamlined process ensures timely payments so you can focus on enjoying retirement.

Tips to Supplement Your NZ Superannuation Income

While NZ Super covers basics, many retirees seek financial comfort by supplementing it:

- KiwiSaver: A defined contribution scheme that allows you to save throughout your working life, providing an extra retirement fund.

- Part-time or casual work: Many retirees enjoy flexible jobs for additional income and social engagement.

- Investments: Property or low-risk financial assets can grow your nest egg.

- Superannuation Advice: Professional financial advisors can tailor strategies to diversify income streams and reduce tax liabilities.

Planning ahead helps avoid retirement money stress and lets you live comfortably.

Common Myths and Mistakes About NZ Super

- Myth: NZ Super pays enough for all expenses.

Truth: It’s a foundation, but extra savings or income are often needed. - Mistake: Waiting until the last minute to apply.

Tip: Apply early to ensure your payments start promptly. - Myth: Moving overseas disqualifies you immediately.

Truth: You can receive NZ Super overseas but must notify authorities and meet conditions.

Knowing facts from fiction helps you make informed choices.

Future Outlook: The Long-Term Picture for NZ Super

The New Zealand Superannuation Fund, created in 2001 and managed independently by the Guardians of New Zealand Superannuation, was established to prepare for the future costs of rising pension demands. The Fund invests in global markets with a responsible investment policy, growing the government’s retirement savings.

As of 2024, the Fund was worth around NZ$76.6 billion, returning about 9.5% annually over 20 years. This strong performance helps buffer tax burdens as more kiwis retire in coming decades.

Looking ahead, the government continuously reviews pension policy, with considerations like:

- Whether to gradually raise the pension eligibility age in line with increasing life expectancy.

- How to adapt to an increasingly mobile population where people live in multiple countries.

- Balancing pension sustainability with social fairness.