Samsung has introduced a transformative feature that makes in-store Buy Now, Pay Later (BNPL) payments easier and more accessible. Through a strategic partnership with Splitit, Samsung Wallet users can now pay for their in-store purchases in convenient installments directly from their Galaxy smartphones. This groundbreaking feature, launched on July 25, 2025, bridges the longstanding gap between online BNPL services and physical retail shopping, offering a seamless checkout experience for millions.

This collaboration integrates installment payments directly into Samsung Wallet, enabling users to split purchases at physical points of sale into smaller payments using their existing credit cards—without any additional credit checks or new account setups. By combining convenience and financial flexibility, Samsung Wallet evolves into a powerful payment tool tailored for the modern shopper.

Samsung Just Made In-Store BNPL Easier With This Unexpected Partnership

| Feature | Details |

|---|---|

| Launch Date | July 25, 2025 (initial rollout in select U.S. states; full expansion planned by end of 2025) |

| Partnership | Samsung Electronics America & Splitit USA Inc. |

| How It Works | Users select “Pay in installments” at checkout via Samsung Wallet on Galaxy smartphones |

| Payment Plans | Multiple options: bi-weekly or monthly installments (e.g., 4, 6, 8, or 9 payments) |

| Credit Checks | No new credit checks or applications required |

| Supported Cards | Most Visa and Mastercard credit cards, except some issuers like JP Morgan Chase Bank |

| Geographical Availability | Began in 23 states + District of Columbia; nationwide rollout expected by end of 2025 |

| Customer Satisfaction | Card-linked installment plans showed higher satisfaction than traditional BNPL, according to industry research |

| Official Website | Samsung Wallet Features |

Samsung’s partnership with Splitit to add BNPL installment payments into Samsung Wallet represents a significant innovation in retail payments. By allowing users to pay for in-store purchases in manageable installments without new credit checks, this feature delivers greater financial flexibility and control to consumers and sales growth opportunities to merchants.

This seamless integration is a shining example of how digital and physical shopping experiences are converging, setting a new standard for contactless, flexible, and rewarding payment solutions. Whether you’re a savvy consumer wanting smarter budgeting or a retailer seeking to enhance customer experience, Samsung Wallet’s installment payment service is a feature to watch and consider.

Understanding Samsung Wallet’s New BNPL Feature

What Is Samsung Wallet?

Samsung Wallet is a versatile digital wallet pre-installed on millions of Galaxy smartphones. It securely stores everything from credit and debit cards to IDs, boarding passes, memberships, and digital keys. With the new addition of installment payments, Samsung Wallet enhances its role as an all-in-one mobile payment and lifestyle tool, combining ease of use with financial flexibility.

What Is BNPL?

Buy Now, Pay Later (BNPL) is a payment method that allows consumers to purchase goods immediately but pay over time through fixed installments. Common in online retail, BNPL offers a budget-friendly alternative to lump-sum payments, often without interest if installments are paid on schedule.

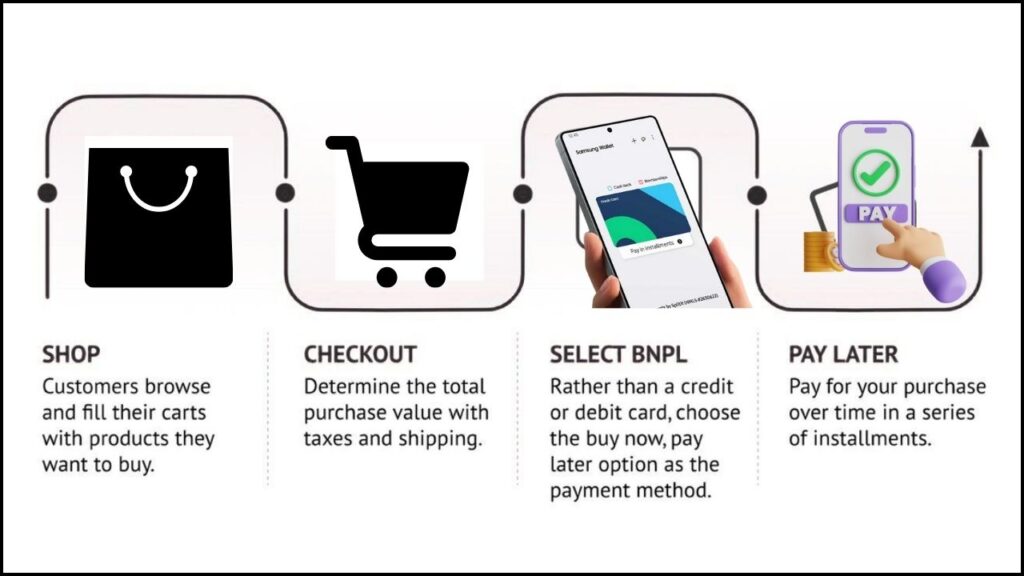

How Samsung Wallet’s In-Store BNPL Works: Step-by-Step

- Shop In-Store at Participating Retailers: Use your Galaxy phone at checkout locations where Samsung Wallet is accepted.

- Choose Samsung Wallet to Pay: Initiate payment by tapping Samsung Wallet as you would with a credit or debit card.

- Select ‘Pay in Installments’: This option appears under your eligible credit cards saved in Samsung Wallet.

- Pick Your Payment Plan: Choose from plans like 4 bi-weekly or 6 to 9 monthly installments based on what fits your budget.

- Complete the Purchase: The total purchase amount is authorized on your existing credit card but split into installments internally by Samsung and Splitit.

- Track Your Payments: Manage and monitor your installment schedule directly within Samsung Wallet with easy reminders and updates.

What sets this apart? Payments use your existing credit card limits, so there’s no requirement for new credit lines or checks. Plus, you keep earning credit card rewards as usual, unlike some BNPL providers that limit rewards.

Why This Matters: The Bigger Picture

The Challenge of In-Store BNPL

Despite BNPL’s explosive growth online, in-store adoption has been slow. This is surprising, considering that physical retail still represents the majority of consumer spending in the U.S. However, in-store BNPL has faced barriers: traditional services often require separate app downloads, new account registrations, or credit checks, which disrupt the smooth checkout flow and deter users.

Samsung and Splitit’s collaboration breaks this mold by embedding BNPL directly within a widely used mobile wallet, delivering:

- A frictionless checkout experience without switching apps or applying for new credit.

- Greater payment flexibility for shoppers in brick-and-mortar stores.

- Improved sales and conversion rates for retailers, with larger average basket sizes.

- A response to consumers’ rising expectations for modern and convenient payment options.

Enhanced Customer Satisfaction

Research consistently shows card-linked installment plans, such as Samsung’s, yield higher customer satisfaction scores than traditional BNPL alternatives. This is driven by a simpler user experience, no surprises with credit impact, and seamless integration with existing payment routines.

Practical Advice for Consumers and Merchants

For Consumers

- Use Your Existing Credit Cards: Choose your current Visa or Mastercard cards saved in Samsung Wallet—no new cards needed.

- Select Plans That Fit Your Budget: Multiple installment options give you the power to spread payments conveniently.

- Easily Monitor Payments: All installment details are visible in Samsung Wallet, eliminating the need for separate portals.

- Check Card Compatibility: Some cards like those from JP Morgan Chase may not yet be supported—verify eligibility in the app.

- No Credit Score Impact: Since this service uses your existing credit, your credit score won’t be affected by the BNPL option alone.

For Retailers

- Attract More Customers: Offering installment payments can entice budget-conscious shoppers and increase average spend.

- Seamless Integration: No need to install additional POS hardware or train staff extensively; Samsung Wallet handles the process.

- Meet Modern Shopper Expectations: Younger shoppers particularly expect flexible, mobile-first payment options even in physical stores.

- Reduce Checkout Abandonment: An easier financing option can help reduce abandoned carts at physical checkouts.

Apple May Tap Anthropic or OpenAI to Reinvent Siri—A Big Shift From Its On-Device AI Strategy

FAQs About Samsung Just Made In-Store BNPL Easier With This Unexpected Partnership

Q1: Is Samsung Wallet’s BNPL feature available everywhere in the U.S.?

A: It currently launched in 23 states plus the District of Columbia as of July 25, 2025, with plans for nationwide availability by the end of 2025.

Q2: Do I need to apply or get a credit check to use Samsung Wallet’s installment payments?

A: No. The BNPL feature works by splitting payments on your existing credit card, so no new accounts or credit checks are necessary.

Q3: Can I use any credit card with Samsung Wallet BNPL?

A: Most Visa and Mastercard credit cards are accepted, except some issuer-specific cards (e.g., JP Morgan Chase currently not supported).

Q4: What happens if I miss a payment?

A: Payments are managed through your credit card issuer’s terms, so late or missed payments may incur fees or interest like any credit card transaction.

Q5: How can I track and manage my installment plan?

A: Samsung Wallet displays your payment schedule and status, allowing you to manage installments easily from your phone.