Artificial Intelligence (AI) has been one of the most exciting and talked-about technologies in recent years. Buzzwords like generative AI, ChatGPT, and machine learning have sparked untold excitement, leading to massive investments in AI startups and projects. But now, many experts warn that the AI bubble may be about to burst. This raises crucial questions. What exactly is an AI bubble? Why do experts say it’s ready to crash? And what does this mean for businesses, investors, and professionals like you? This article aims to break down these questions in simple terms—with clear examples, key statistics, and practical advice.

Table of Contents

What is the AI Bubble?

An economic bubble happens when people get too excited about a new technology or investment, pushing prices and valuations far beyond what the technology or company can realistically deliver. The “AI bubble” refers to the rapid rise in enthusiasm and investment in AI—much like the dot-com bubble of the late 1990s and early 2000s when internet company stocks soared, only to crash dramatically later.

In the AI bubble case:

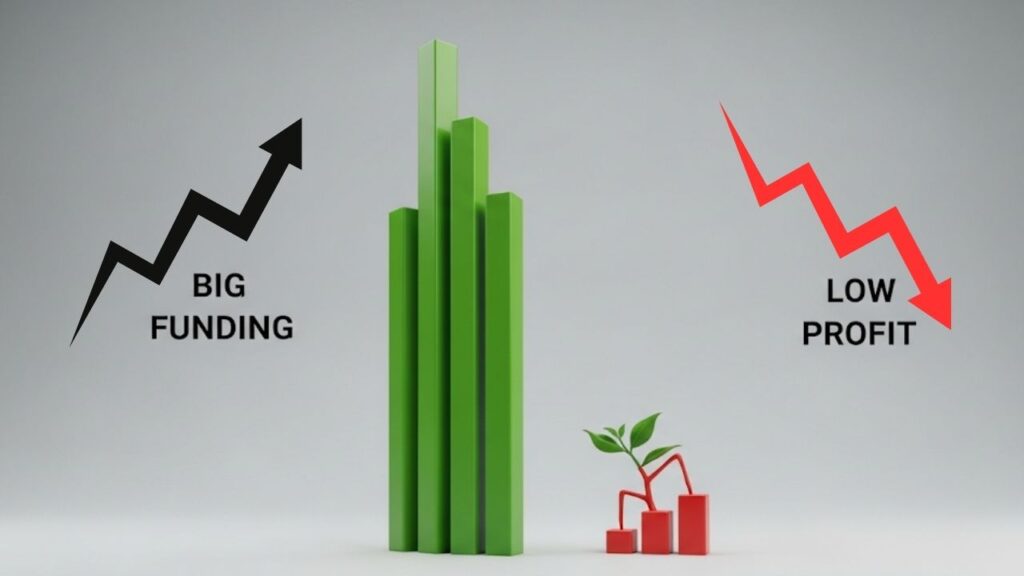

- Companies and investors have poured $30 to $40 billion into generative AI projects.

- Yet, according to a recent report from Massachusetts Institute of Technology (MIT), 95% of these AI investments have shown zero measurable return for businesses.

- Large tech stocks associated with AI, such as Nvidia and Palantir, have already experienced significant drops—Nvidia shares fell 3.5%, Palantir 9%, and some startups like CoreWeave lost billions in market value in just a few days.

- AI projects have failed or stalled, and the much-anticipated AI revolution hasn’t yet translated into profits or cost savings as promised.

Say Farewell to the AI Bubble

| Topic | Details |

|---|---|

| AI Investment | $30-40 billion spent on generative AI projects but 95% of organizations report zero return (MIT, 2025) |

| AI Market Size | Global AI market worth approximately $391 billion, projected to grow 5x by 2030 (Exploding Topics, 2025) |

| Stock Impact | Nvidia down 3.5%, Palantir down 9%, CoreWeave lost $23 billion market cap recently |

| Failed Projects | 50% of AI projects fail; only 5% generate millions in value (MIT survey) |

| Expert Warnings | OpenAI CEO Sam Altman and others admit AI market is in a bubble resembling the dot-com crash |

| Future Outlook | $3 trillion estimated capital needed by 2028 to expand AI infrastructure — but returns uncertain (Morgan Stanley) |

| Official Reference | MIT AI Investment Report |

The much-anticipated AI bubble appears to be bursting as enthusiasm meets the reality of limited returns and stalled breakthroughs. While the technology itself is transformative, the current market is overheated with overvalued stocks and failing projects. For businesses, the key is to approach AI investments pragmatically—running pilots, measuring returns, and scaling responsibly. Investors should brace for volatility, and professionals must focus on upskilling to collaborate effectively with AI tools.

Understanding this shift today will empower you to navigate the upcoming changes more confidently and profitably—turning potential crisis into opportunity.

Why is the AI Bubble Bursting Now?

1. Hype vs. Reality

When AI chatbots like OpenAI’s ChatGPT launched in 2022, hype around AI’s transformative potential soared. Many executives expected instant cost savings and productivity boosts. However, MIT’s study found that most AI projects have yet to deliver measurable impact. The gap between expectations and real outcomes is a major factor weakening confidence.

2. High Valuations Without Profits

Valuations of AI companies and stocks have ballooned, driven more by speculation than actual profits. For example, CoreWeave, an AI infrastructure startup, lost 30% of its share value after revealing widening losses. This reminds experts of how Pets.com, a dot-com bubble poster child, was overvalued before collapsing.

3. Scaling Challenges and Market Saturation

The AI industry’s vast demand for computing power and data has led to a capital requirement projection of $3 trillion by 2028 (Morgan Stanley). Yet the latest release of GPT-5 by OpenAI failed to meet expectations for improved capabilities. This challenges the assumption that simply adding more data and processing power (scaling up) will bring revolutionary AI breakthroughs.

4. Scaling Back and Failures

Some tech giants, like Meta and SoftBank, are slowing or abandoning AI projects that aren’t meeting expectations. Around half of AI projects surveyed by MIT failed outright or were cut back, signalling trouble in the market.

What This Means for Businesses & Professionals

AI Investment Strategy: Be Cautious Yet Open

- Don’t chase hype blindly. Focus on AI projects with clear business cases and measurable goals.

- Pilot first, then scale. Run small-scale AI pilots and assess the results before large investments.

- Invest in talent and training. Ensure employees understand AI tools and how to integrate them usefully.

- Look for cross-industry applications. Healthcare, finance, and manufacturing show promising AI uses beyond chatbots.

For Investors: Prepare for Volatility

The AI sector may experience sharp market corrections. Diversify portfolios and avoid putting all investments in AI stocks or startups. Keep an eye on companies showing consistent profitability and innovation rather than hype-driven valuations.

For Professionals: Adapt and Upskill

AI tools are here to stay, but the nature of work will change. Upskilling in AI literacy, data analysis, and AI tool integration will make professionals more valuable and future-proof careers. Understand AI’s limitations alongside capabilities to make smarter decisions.

How to Navigate the AI Bubble Burst: A Step-By-Step Guide

- Stay InformedFollow reliable sources such as MIT reports, financial news outlets (CNBC, Financial Times), and AI research blogs for updates on market and technology trends.

- Evaluate ROI CarefullyBefore adopting AI, calculate expected returns: cost savings, revenue growth, or efficiency gains. Don’t rely solely on vendor promises or industry buzz.

- Pilot Before BuyStart with small-scale projects; measure clear KPIs like productivity improvement or customer satisfaction.

- Prepare for Change ManagementTrain teams on AI tools and communicate clearly about what AI can and cannot do.

- Focus on Long-Term ValueInvest in robust AI infrastructure, data quality, and cross-functional collaboration rather than chasing quick wins.

- Diversify AI ToolsExperiment across different AI applications—automation, analytics, customer service—to discover best fits for your business.

- Plan for Market VolatilityFinancially prepare for potential downturns in AI investment valuations and stock prices.

SuperAlgorithm.ai Breaks Big Tech’s AI Monopoly: A New Era in Global Artificial Intelligence

Meta Launches New AGI Lab to Dominate the Future of Artificial Intelligence

Meta AI Edges Toward Superintelligence: A New Era of Personal Empowerment

FAQs About Say Farewell to the AI Bubble

Q1: Is AI still worth investing in despite the bubble?

Yes. AI technology is advancing and will reshape industries. However, it’s vital to approach investments strategically, focusing on realistic benefits rather than hype.

Q2: How can businesses avoid getting caught in the AI bubble crash?

By conducting pilot tests, measuring tangible impacts, avoiding overhyped vendors, and integrating AI sensibly into existing workflows.

Q3: Will the AI crash be worse than the dot-com bubble?

Some experts believe the AI crash could cause more investor losses than the dot-com crash because AI valuations and capital invested are much higher.

Q4: What should professionals do to stay relevant?

Learn AI literacy, develop skills to collaborate with AI systems, and stay updated with evolving AI tools in your field.