Taiwan Semiconductor Manufacturing Company (TSMC) isn’t just another name on a stock ticker—it’s the invisible force that powers your smartphone, your laptop, and the artificial intelligence (AI) technologies reshaping industries. In July 2025, TSMC did something never before achieved by an Asian company: its market capitalization, the total value all its shares, surged beyond $1 trillion and even briefly touched $1.27 trillion. That’s more than the biggest oil companies, automakers, or banks—putting TSMC among the world’s top 10 most valuable corporations, just behind household names like Apple, Microsoft, and Amazon.

But why is a company most people have never heard of suddenly worth more than entire industries? The answer lies in advanced chips, the AI boom, and TSMC’s unmatched manufacturing technology. Let’s break down this historic milestone, explore what it means for you, and look ahead to what comes next.

Table of Contents

TSMC Surpasses $1 Trillion

| What Happened? | Key Numbers | Why It Matters | For Careers & Investors |

|---|---|---|---|

| TSMC’s market cap hit $1 trillion (peaked at $1.27T) | $106.1 billion annual revenue; $45.4 billion net profit; 43% profit margin | TSMC makes the chips that power almost every major tech device and AI system. Its growth reflects the AI revolution. | Surging demand for semiconductor engineers, AI specialists, and tech business roles. TSMC stock is among the world’s most valuable. |

TSMC’s $1 trillion+ valuation is a landmark for the tech industry and a clear signal that AI is the new engine of global growth. The company’s rise is built on technological leadership, strategic partnerships, and the world’s hunger for powerful chips. For professionals, investors, and everyday users alike, TSMC’s success is a reminder that innovation at the smallest scale can have the biggest impact.

How TSMC Became the World’s Most Valuable Chipmaker

The Secret Sauce: TSMC’s Technology Leadership

TSMC is the world’s largest contract chip manufacturer—a “foundry” that builds chips designed by other companies. Unlike Intel, which designs and makes its own chips, TSMC’s business is purely manufacturing. This approach, called the third-party foundry model, has given TSMC unique flexibility and scale, allowing it to serve tech giants like Apple, Nvidia, AMD, Qualcomm, and Broadcom.

The real magic is in how small they can make their transistors. Transistors are the tiny switches in chips that do the computing. The smaller the transistor, the more you can pack into a chip—and the faster and more efficient it becomes. TSMC’s most advanced chips use 3-nanometer and 5-nanometer processes, with billions of transistors on a slice of silicon smaller than your thumbnail. In the latest quarter, 74% of TSMC’s wafer revenue came from these ultra-advanced chips (7-nanometers or smaller), highlighting its dominance in cutting-edge manufacturing.

AI Chips Are the New “Oil”

Oil fueled the industrial age; AI chips are fueling the digital age. TSMC’s record growth is directly tied to the exploding demand for chips that train AI models, process vast amounts of data, and enable everything from smart assistants to self-driving cars. High-performance computing and AI chips now make up 60% of TSMC’s wafer revenue, a major shift from its previous reliance on smartphones and consumer electronics.

Companies like Nvidia (makers of GPUs for AI training) and Apple (makers of iPhones and MacBooks) are TSMC’s biggest customers. As AI adoption accelerates, orders for these chips are skyrocketing—with no sign of slowing down.

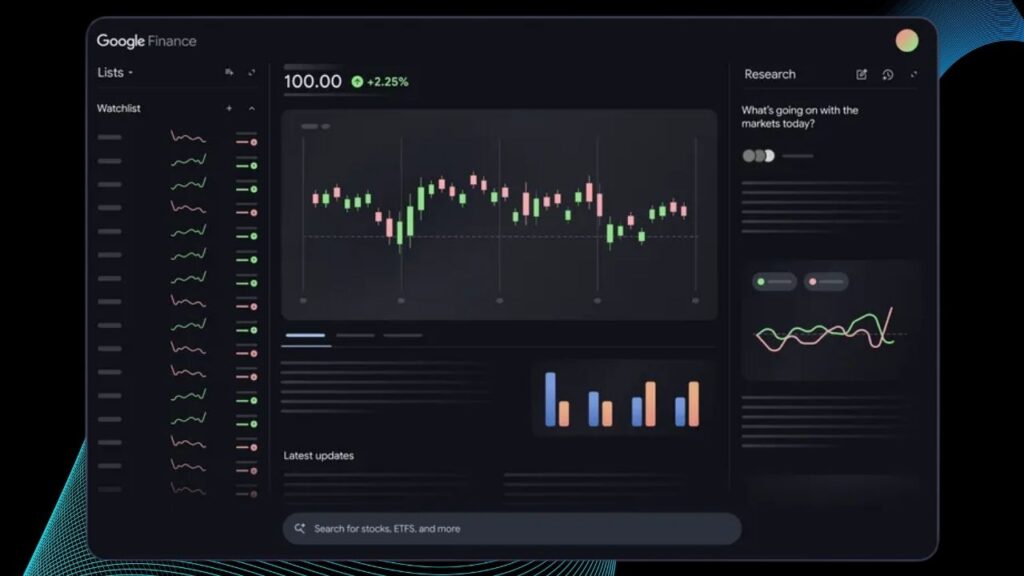

Financial Performance: Record-Breaking Quarters

In the first half of 2025, TSMC’s revenue jumped 40% year-over-year to $55.7 billion. Over the last 12 months, it generated $106.1 billion in revenue and $45.4 billion in net profit. That kind of profitability—with a 43% profit margin—is rare in manufacturing and reflects TSMC’s ability to command premium prices for its technology.

In the second quarter alone, net profit surged nearly 61% year-over-year, far exceeding analysts’ expectations. Revenue for that quarter was NT$933.8 billion (about $28.6 billion), up 39% from the previous year. Third-quarter revenue is expected to hit $31.8–$33.0 billion, another 38% year-over-year increase, showing that demand remains red-hot.

Why This Matters for You—Whatever Your Background

For Everyday Users

Every time you unlock your iPhone with Face ID, ask a chatbot a question, or play a graphics-heavy video game, you’re using technology made possible by TSMC chips. The company’s products are inside nearly every major consumer electronics brand, even if you’ve never heard of TSMC itself. Its success means faster, smarter, and more efficient devices for everyone—year after year.

For Professionals and Job Seekers

The semiconductor industry is booming. Careers in chip design, semiconductor engineering, AI development, and advanced manufacturing are in high demand, with salaries and opportunities rising rapidly. TSMC and its ecosystem partners are hiring aggressively, offering stable, high-paying jobs in a future-proof industry.

If you’re looking to future-proof your career, skills in AI, chip design, data science, and advanced manufacturing are excellent bets. Educational institutions are expanding programs in these areas to meet the skyrocketing demand.

For Investors

TSMC is now the world’s 9th most valuable company, and its stock has surged nearly 50% from its April 2025 low. That’s a remarkable gain for a company already valued in the hundreds of billions. Investor confidence is high because TSMC’s technology lead is so strong, its customer base so broad, and its growth so consistent.

However, investing in TSMC—or any semiconductor stock—comes with risks. Geopolitical tensions around Taiwan, supply chain disruptions, and rapid technological change can all impact performance. Diversification and a long-term perspective are key.

For Businesses and Entrepreneurs

Building a tech product today means understanding the chip supply chain. TSMC’s dominance means most advanced devices depend on its chips, and shortages or delays can ripple through the entire industry. For startups and established companies alike, relationships with chip suppliers are now as important as software partnerships.

A Step-by-Step Guide to TSMC’s Rise to a Trillion-Dollar Giant

1. Build the Best “Kitchen” in the World

TSMC invested billions to develop the most advanced chip manufacturing plants (“fabs”) on earth. Its 3nm and 5nm processes are years ahead of competitors, allowing it to make chips no one else can.

2. Partner with the Tech Titans

Apple, Nvidia, AMD, Broadcom, Qualcomm, and many more design their chips but rely on TSMC to manufacture them. These partnerships create steady, growing demand and lock in TSMC’s position as the industry’s backbone.

3. Ride the AI Wave

As AI became the biggest trend in tech, TSMC shifted its focus from smartphones to data centers and AI chips. High-performance computing is now its biggest business, and the company expects this trend to continue.

4. Scale Up—Fast

TSMC is spending $38–42 billion this year on new factories and research, with multi-year plans to invest even more. This ensures it can meet the world’s insatiable appetite for advanced chips.

5. Profit from Efficiency

With gross margins above 40% and net profit margins near 43%, TSMC makes more money per chip than almost any other manufacturer. This financial strength funds future growth and innovation.

6. Keep Innovating

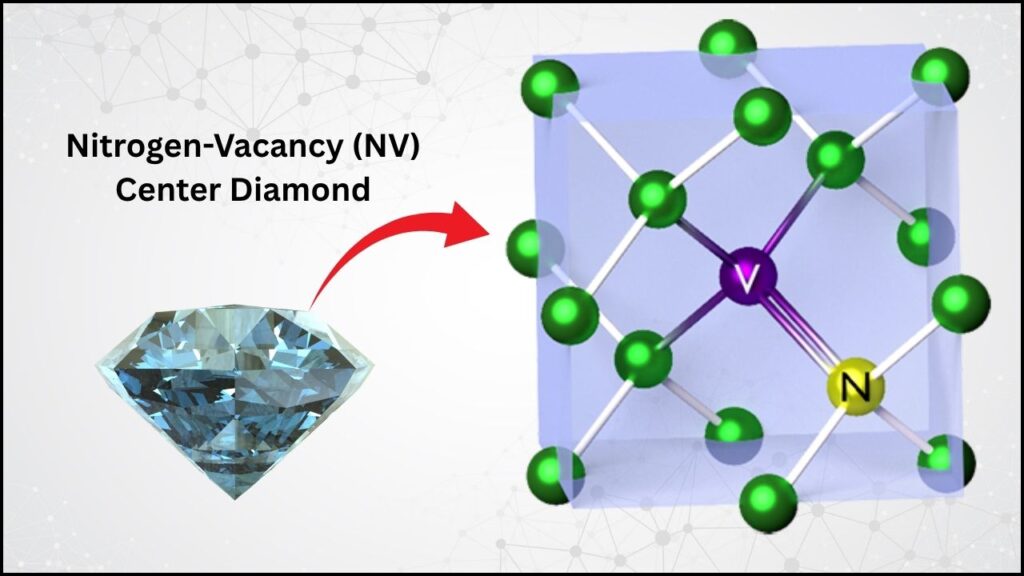

TSMC is already working on 2-nanometer chips, which will power the next generation of AI, quantum computing, and beyond. Its relentless focus on R&D keeps it ahead of rivals.

Challenges and Risks: What Could Go Wrong?

No company is invincible—not even TSMC. Here are the biggest risks on the horizon:

- Geopolitical Tensions: TSMC is headquartered in Taiwan, a self-governed island that China claims as its territory. Any escalation in tensions could disrupt supply chains and global tech markets.

- Technological Disruption: Rivals like Samsung and Intel are investing heavily to catch up. Breakthroughs in alternative chip technologies could challenge TSMC’s dominance.

- Economic Cycles: Booms can turn to busts. If AI investment slows or global growth stalls, TSMC’s growth could decelerate.

- Supply Chain Vulnerabilities: Advanced chipmaking relies on a complex, global supply chain. Disruptions—from natural disasters to trade disputes—can impact production.

Despite these risks, TSMC’s technology lead, customer relationships, and financial strength give it a sturdy foundation for the years ahead.

China’s AI Chip War Strategy May Already Be Outpacing the West’s Response

FAQs About TSMC Surpasses $1 Trillion

Q: What does “market capitalization” mean?

A: It’s the total value of all a company’s shares—how much it would cost to buy every piece of the company at the current stock price. For TSMC, that’s now over $1 trillion.

Q: Why is TSMC so important?

A: TSMC makes the most advanced chips for nearly every major tech company. Without TSMC, most smartphones, laptops, AI systems, and even many cars wouldn’t function as they do.

Q: Is TSMC bigger than Apple or Microsoft?

A: Not yet—Apple and Microsoft are each worth over $3 trillion. But TSMC is now among the world’s top 10 most valuable companies, ahead of most industrial and consumer giants.

Q: What are the risks for TSMC?

A: The main risks are geopolitical tensions, supply chain disruptions, technological competition, and economic downturns. But for now, TSMC’s tech and business advantages are substantial.

Q: How does this affect me if I’m not an investor or engineer?

A: Every digital device you use probably relies on TSMC chips. The company’s success means faster, smarter gadgets and a more connected world.